The Urban Institute (UI) says the five government mortgage lenders and their various ways of accounting for income-driven repayment (IDR) plans are inhibiting the ability of many potential homebuyers to buy a home. IDR plans are used by many student loan programs and require special handling in mortgage underwriting.

The problem with an IDR arises in the calculation of the debt-to-income (DTI) ratio, the percentage of a borrower's income that is committed to debt service including payment on student loans. While there has recently been a little easing of what had been fairly rigid caps on DTI, higher ratios still limit a borrower's ability to get a mortgage or increase the cost of the loan.

The three government agencies that guarantee mortgages, (FHA, the VA, USDA's Rural Home Loan program) and the two government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, each use a different way of accounting for IDR plans in the DTI calculation. UI says this is confusing to borrowers and has disadvantaged some potential first-time homebuyers.

Looking at existing student loan debt, the UI researchers found that about 30 percent of borrowers in repayment use an IDR plan. The monthly payment on these plans is typically about 10 percent of the borrower's income above 150 percent of the federal poverty level and is reset annually. Borrowers with incomes below that level make no payment.

Student loans without an IDR plan have a fixed monthly payment which is figured into the DTI in the same manner as other debt. However, each government lender has its own method for managing IDRs and most seem not to take into account that many borrowers who can't afford to make full payments on their student loans are still good candidates for mortgages

- Fannie Mae generally uses the monthly IDR payment, even if it is $0.

- Freddie Mac uses the monthly IDR payment, unless it is $0, in which case, it uses 0.5 percent of the loan balance (e.g., $125 per month on a $25,000 loan).

- The FHA and USDA ignore the IDR payment amount and assume a 1 percent monthly payment ($250 per month on a $25,000 balance).

- The VA gives lenders the option of using the IDR payment amount or using 5 percent of the outstanding balance per year ($104.17 per month on a $25,000 loan).

In short, Fannie Mae always takes the actual IDR amount into account when calculating DTI ratios; Freddie does so, except when the payment is $0; the FHA and USDA do not take the actual IDR amount into account; and the VA leaves it up to the lender.

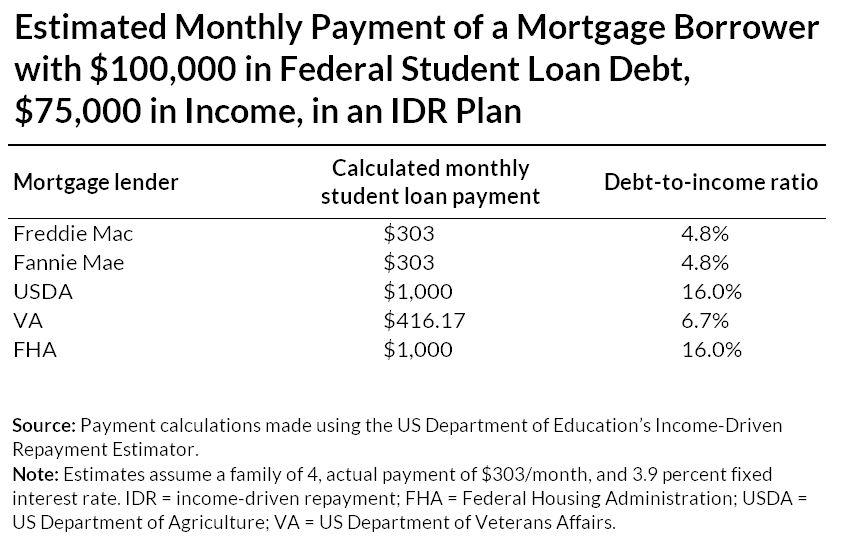

UI illustrates how these various methods could affect those applying for a loan. The scenario is a family with a solid household income of $75,000 per year but extremely high student loan debt of $100,000 which would qualify them for an IDR plan.

Under a standard repayment plan they would pay about $1,000 per month for their student loans, but under the Revised Pay As You Earn (REPAYE) IDR plan, they would pay just $303 per month. The chart below shows how that payment would be treated by each of the five lenders' underwriting policy.

The writers urge all five of the government institutions to adopt the same standard for IDR loans. The programs should be aligned to the fairest and most logical standard for addressing IDR plans and they suggest that the one that makes the most sense from an underwriting standpoint is to allow the DTI ratio to "count" only the actual amount paid.

Mortgage underwriting assesses only actual income, not income earning potential. If someone is on the steep part of their earnings curve, the potential earnings are not considered. Similarly, only actual debt service payments should be considered, not potential payments. The borrower's IDR payments will increase only when their income increases, giving the borrowers more capacity to repay a mortgage.

Consistency across the five government institutions in taking IDR into account will ensure that no borrower will be disadvantaged simply because of the program they choose for their mortgage.