The Obama Administration released the Fiscal Year 2011 Budget. To put the size of this document in perspective: the SUMMARY TABLES alone required 36 pages.

The main focus of the budget: CREATING JOBS

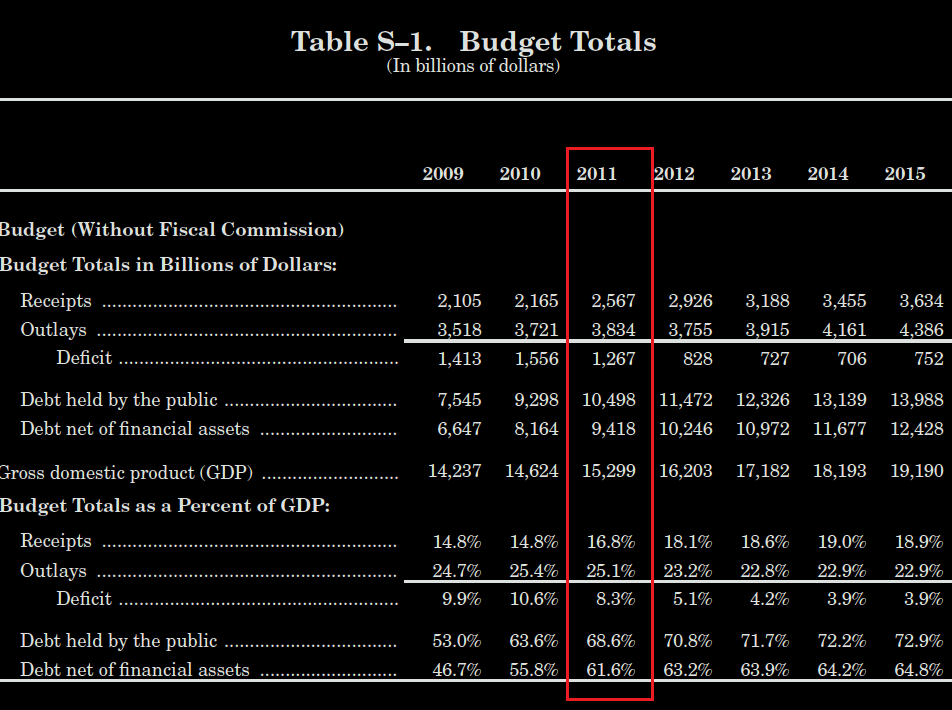

TOTAL 2011 BUDGET TO ACCOMPLISH THIS GOAL: $3.834 trillion

THE WHITE HOUSE SAYS:"Having steered the economy back from the brink of a depression, the Administration is committed to moving the Nation from recession to recovery by sparking job creation to get millions of Americans back to work and building a new foundation for the long-term prosperity for all American families. To do this, the 2011 Budget makes critical investments in the key areas that will help to reverse the decline in economic security that American families have experienced over the past decade with investments in education, clean energy, infrastructure, and innovation."

HERE is the message from the President. Its five pages long and basically re-iterates the above statement. This is how he ends his message: "These have been tough times, and there will be difficult months ahead. But the storms of the past are receding; the skies are brightening; and the horizon is beckoning once more"

I think the National Council of State Housing Agencies outlined it best. I did re-order the proposals based on popularity.

Summary

The Administration yesterday sent Congress its FY 2011 Budget, proposing funding for all federal programs, including HUD and the Department of Agriculture’s (USDA) rural housing programs. It also contains the Administration’s tax proposals, including an extension of the Housing Credit Exchange program in 2010 and the extension and expansion of the Build America Bonds program. The Budget also says that the Administration will ask Congress for authorization to increase the Federal Housing Administration (FHA) annual single-family mortgage insurance premium.

The Budget does not contain a proposal to reform the housing Government-Sponsored Enterprises (GSE), Fannie Mae and Freddie Mac, but HUD Secretary Shaun Donovan said the Administration will release a GSE reform proposal soon.

NCSHA’s preliminary analysis of the Budget’s housing proposals follows....

Government-Sponsored Enterprise (GSE) Reform: Despite Administration officials' repeated statements over the last few months that the Administration would be putting forward its planfor the housing GSEs, Fannie Mae and Freddie Mac, with the FY 2011 Budget, its only comment about GSE reform says, "The Administration continues to monitor the situation of the GSEs closely and will continue to provide updates on considerations for longer term reform of Fannie Mae and Freddie Mac as appropriate."

HUD Secretary Shaun Donovan said today that the Administration will issue its GSE reform proposal soon but did not reveal when or provide any information on the proposal.

HUD:The Administration proposes $41.6 billion in HUD budget authority, a $1.99 billion, or 5 percent, decrease from the $43.6 billion HUD appropriation provided under the FY 2010 omnibus spending bill the President signed December 16.

After accounting for offsetting receipts, mostly from the FHA mortgage insurance program, the Budget proposes to spend $48.5 billion on HUD programs, a $1.5 billion increase over its 2010 funding.

Federal Housing Administration (FHA): The Budget says that the Administration will ask Congress for authorization to increase the FHA annual single-family mortgage insurance premium to .85 percent of the loan amount for most mortgages and .90 percent for low-downpayment mortgages from the current .50 percent for all mortgages. HUD recently announced it is increasing the FHA upfront premium to 2.25 percent from 1.75 percent. If Congress approves the annual premium increase, HUD will reduce the upfront premium to 1 percent.

The Budget increases Housing Choice Voucher funding by 8 percent, the project-based Section 8 program by 9 percent, and homeless assistance by 11 percent. The Budget maintains funding at the FY 2010 level for CDBG. It cuts funding for HOME, Section 202 Housing for the Elderly, and Section 811 Housing for Persons with Disabilities. The Budget also proposes $1 billion in new funding to launch the Housing Trust Fund.

The Budget proposes to eliminate the Rural Housing and Economic Development program and the Brownfields Economic Development Initiative. The Budget again proposes to replace the HOPE VI program with the Choice Neighborhoods Initiative.

Combating Mortgage Fraud: The Budget requests $20 million for the FHA Mortgage Fraud Initiative, launched last year, to combat mortgage fraud and predatory practices. The request is equal to FY 2010's funding level.

HOME: The Budget proposes $1.65 billion for HOME, a $175 million, or 10 percent, decrease in its FY 2010 funding level of $1.825 billion.

Rural Housing Programs: The Budget proposes $1.2 billion for the Section 502 single-family subsidized direct loan program, a $1 million increase over FY 2010. It also recommends an increase of $5.8 billion in funding for the Section 502 unsubsidized guaranteed loan program to $12 billion.

The Budget proposes $95.2 million for the Section 515 rural rental housing loan program, an increase of $25.7 billion. It also proposes to fund the Section 538 multifamily loan guarantee program at $129 million, the same amount as in FY 2010.

The Budget proposes $18 million for the Section 542 rural housing voucher program, $2 million, or 13 percent, more than appropriated in FY 2010. The program provides vouchers for families living in Section 515-assisted properties whose owners prepay their mortgages.

Rural Housing and Economic Development (RHED): The Budget proposes no new funding for RHED. RHED provides capacity-building and program grants to nonprofits and public agencies supporting housing and community development in rural areas.

Build America Bonds: The Administration proposes to make the Build America Bond (BAB) program permanent in a way designed to be approximately revenue neutral in comparison to the federal tax cost from traditional tax-exempt bonds. The Administration also proposes to expand the BAB program beyond new investments in governmental capital projects to include certain additional uses for which state and local governments may use tax-exempt bonds under existing law. This may include allowing issuers to use BABs for private activity bond-eligible activities, including housing.

Housing Counseling: The Budget proposes $88 million for housing counseling, the same amount as its FY 2010 appropriation. The Budget also proposes $113 million for the Neighborhood Reinvestment Corporation's National Foreclosure Mitigation Counseling program, a $48 million increase over the 2010 funding level.

Housing Credit Exchange Program: The Budget proposes to extend the Housing Credit Exchange program for an additional year. If Congress accepts this proposal, which the House included in the Tax Extenders Act of 2009 and the Senate has under consideration, states would be allowed to exchange: their unused 2009 Housing Credit ceiling; Credits returned in 2010; up to 40 percent of the state's 2010 per capita authority; and up to 40 percent of the state's share of the 2010 national pool allocation, if any. The proposal would not allow states to exchange 4 percent or Disaster Credits. States would be required to use their Credit Exchange funds by December 31, 2012.

Community Development Fund: The Budget proposes to fund the Community Development Fund at $4.38 billion, a $70 million, or 2 percent, decrease in the FY 2010 appropriation, and to maintain CDBG funding within it at $3.99 billion.

The Budget proposes a number of improvements to the CDBG program, including redesigning the state and local government consolidated plans and planning process, increasing accountability, and improving performance metrics in grantee reporting.

Sustainable Communities: The Budget proposes $150 million for the Sustainable Communities Initiative, equal to 2010 funding. This initiative has four parts. First, HUD will continue to collaborate with the Department of Transportation (DOT) and the Environmental Protection Agency (EPA) to offer Sustainable Communities Planning Grants. This program is designed to catalyze integrated metropolitan transportation, housing, land use, and energy planning, using sophisticated data, analytics, and geographic information systems. These integrated plans are created to inform state, metropolitan, and local transportation, infrastructure, and housing investments. Second, the initiative will fund challenge grants to help localities implement the Sustainable Communities Plans. Third, the proposal will support the creation and implementation of a capacity-building program and tools clearinghouse designed to support both Sustainable Communities grantees and other communities interested in becoming more sustainable. Finally, the Initiative will provide funding for a joint HUD-DOT-EPA research effort designed to advance transportation and housing linkages.

HOPE VI/Choice Neighborhoods Initiative: The Budget proposes no new funding for the HOPE VI program for revitalization of severely distressed public housing, as it proposes to replace it with the $250 million Choice Neighborhoods Initiative. HOPE VI was funded at $200 million and Choice Neighborhoods was funded at $65 million in FY 2010.

Choice Neighborhoods' goal is to transform extremely poor neighborhoods into functioning, sustainable mixed-income neighborhoods with appropriate services, schools, public assets, transportation, and access to jobs. The Choice Neighborhoods grants will primarily fund the preservation, rehabilitation, and transformation of public and HUD-assisted housing. The program builds on the success of HOPE VI with a broader approach to concentrated poverty. Grantees will include PHAs, local governments, nonprofits, and for profit developers. Grant funds can be used for resident and community services, community development and affordable housing activities in surrounding communities, and multifamily or single-family property disposition, including the conversion of these properties to affordable housing. The program will also implement rent and work incentives to help public and HUDassisted housing residents access jobs and move to self-sufficiency.

Housing Choice Vouchers: The Budget proposes $19.6 billion for Housing Choice Vouchers, 8 percent more than the FY 2010 appropriation of $18.2 billion. Of this amount, the Administration proposes $17.3 billion for expiring voucher renewals, $971 million more than the FY 2010 appropriation. The Budget also proposes a $150 million fund for adjusting PHA renewal allocations to account for unforeseen circumstances, including portability-associated cost increases, the same as in FY 2010.

The voucher program funding includes $1.79 billion for PHAs' administrative costs, $216 million more than the FY 2010 appropriation. The proposed administrative fee total includes $50 million for the Secretary to allocate as he deems necessary to PHAs requiring additional administrative funds and for fees associated with tenant protection vouchers.

The Budget proposes continuing funding for all existing mainstream vouchers, including new vouchers awarded in 2010, as well as $85 million in new special purpose vouchers for homeless and at-risk of homelessness families with children, and persons with disabilities. In addition, HUD proposes to design a comprehensive development strategy to improve HUD IT systems to manage and administer the voucher program, implement an improved Section 8 Management Assessment Program, improve administrative fee allocations based on the cost of an efficiently managed PHA, develop a study to evaluate current Housing Quality Standards (HQS) and improve the unit inspection process, and eliminate the cap restriction on the number of families that each PHA may serve.

Section 8 Project-Based Rental Assistance: The Budget proposes $9.1 billion to renew expiring Section 8 project-based contracts, a $734 million, or 9 percent, increase in the FY 2010 appropriation of $8.3 billion. HUD's budget materials say this amount will preserve approximately 1.3 million affordable rental units through increased funding for contracts with private owners of multifamily properties. The Budget also proposes $322 million for performance-based contract administrators' administrative fees, $64 million more than in FY 2010.

Transforming Rental Assistance (TRA): The Budget proposes to initiate a multi-year effort called the Transforming Rental Assistance (TRA) initiative to regionalize the Housing Choice Voucher Program and convert public housing and some assisted housing to project-based vouchers. The primary goals of this initiative are to improve the physical condition and management of the public housing stock, increase the mobility of assisted families, and streamline HUD oversight of its rental assistance programs. The Budget proposes $350 million in FY 2011 to fund the first phase of this initiative and preserve approximately 300,000 units of public and assisted housing, increase administrative efficiency at all levels of program operations, and enhance housing choice for residents.

HUD's budget materials indicate that by the spring of 2010, the Administration will transmit to Congress proposed legislation to amend the project-based voucher program to authorize long-term property-based rental assistance contracts with a resident mobility feature.

Housing Trust Fund: The Budget requests $1 billion in mandatory spending, subject to PAYGO legislation, to capitalize the Housing Trust Fund.

Catalytic Investment Competition: The Budget proposes under the Community Development Fund, $150 million for a new initiative, the Catalytic Investment Competition Grants program, which will provide economic development and gap financing to implement and capitalize innovative and targeted economic investment for neighborhood and community revitalization for low- to moderate-income families. Projects may implement activities to augment the Choice Neighborhoods Initiative, Promise Neighborhoods, HOPE VI, Sustainable Communities, or other place-based strategies to help strengthen existing and planned investments in targeted neighborhoods to improve economic viability, extend neighborhood transformation efforts, and foster viable and sustainable communities. Applicants will be required to leverage other federal community development resources.

Homeless Assistance: The Budget proposes $2.06 billion for homeless assistance, $187 million more than its FY 2010 appropriation, an increase of 11 percent.

In 2011, the Administration will implement the HEARTH Act, which combined HUD's three competitive grant programs: Shelter Plus Care, Supportive Housing, and Section 8 Moderate Rehabilitation Single Room Occupancy.

Housing for the Elderly and for Persons with Disabilities: The Budget proposes $274 million for the Section 202 Housing for the Elderly program, $551 million less than in FY 2010. The Budget proposes $90 million for the Section 811 Housing for Persons with Disabilities program, $210 million less than in FY 2010.

The Budget proposes to eliminate construction funding for new projects in order to redesign the programs and institute reforms that will ensure that future projects are more cost effective and well-targeted. The Budget also proposes to shift the $113.6 million required to renew nearly 15,000 Mainstream Vouchers from the Section 811 account to the tenant-based rental assistance account.

Public Housing: The Administration proposes to provide $2 billion for the Public Housing Capital Fund, $455.8 million, or 18 percent, less than in FY 2010. The Budget proposes $4.8 billion for the Public Housing Operating Fund, $54 million, or 1 percent, more than last year.

AIDS Housing: The Budget proposes $340 million for the Housing Opportunities for Persons with AIDS (HOPWA) program, $5 million more than its FY 2010 appropriation.

Lead-Based Paint Hazard Reduction: The Budget proposes $140 million for the Lead Hazard Reduction Program, the same as its FY 2010 appropriation.

Capacity Building: The Budget proposes $60 million for a redesigned Capacity Building program. This competitive grant program is designed to develop the capacity and ability of community development corporations, community housing development organizations, and local governments to undertake community development and affordable housing projects and programs for low-income families. In addition to nonprofit intermediaries and other consortia, this program will work with states and cities to help them readily understand how to meet the needs of their communities, leverage private and other kinds of resources, and align existing programs to build resilience in difficult economic times. Grants provided under this program will require a three-to-one match from private sources.

Energy Innovation Fund: The Budget supports the continuation of the Energy Innovation Fund, which is intended to stimulate and enhance private investment in cost-saving energy efficiency retrofits of existing housing, through improved use of FHA single-family and multifamily mortgage products. The Energy Innovation Fund provides support for promising local initiatives that can be replicated across the nation. HUD did not request new funds for FY 2011 as it anticipates that the FY 2010 appropriation of $50 million will fund significant pilot activity through FY 2011.

Transformation Initiative: The Budget proposes $20 million for the Transformation Initiative to transform and revive HUD, the same as its FY 2010 funding level. In addition, up to 1 percent of each program's funding would be transferred to this fund for: research, evaluation, and program metrics; program demonstrations; information and technology; and technical assistance and capacity building.

HUD SAYS: "HUD’s budget proposal seeks to make targeted investments in people and places – instead of policies and programs –to effectively support HUD’s mission while being accountable to the American taxpayer. $6.9 billion in projected FHA and Ginnie Mae receipts contribute to the FY 2011 proposed $48.5 billion budget total and to the administration’s deficit reduction plans. Net of the $6.9 billion in projected FHA and Ginnie Mae receipts the Budget proposes overall funding of $41.6 billion, 5% below fiscal year 2010, and makes difficult decisions to cut funding for a number of programs."

The carefully targeted investments in the Budget will enable HUD programs to:

- House over 2.3 million families in public and assisted housing (over 58% elderly or disabled);

- Provide voucher assistance to 78,000 additional families (over 47% elderly or disabled);

- Assist nearly 5.5 million households, over 200,000 more than at the end of fiscal year 2009.

- More than double the annual rate at which HUD assistance creates new permanent supportive housing for the homeless;

- Create and retain over 112,000 jobs through the Department’s housing and economic development investments in communities across the country.

THE MORTGAGE BANKERS ASSOCIATION SAYS:

The Mortgage Bankers Association (MBA) issued the following reactions and analysis to the fiscal year 2011 federal budget, as proposed today by the Obama Administration.

"Reducing the federal deficit is vital to the long-term health of the US economy and our industry. However, we believe it can and should be done without negatively impacting the already-fragile housing market," said Robert E. Story, Jr., CMB, MBA's Chairman. "Limiting the mortgage interest deduction and imposing additional taxes on lenders will only make economic recovery more difficult."

MBA opposes the proposal to reduce itemized deductions, including the deduction of mortgage interest, for taxpayers reporting income above $250,000 (joint) $200,000 (single). This would have a negative impact on the housing market, particularly in high cost states like California and New York, as it would increase the cost of mortgages for many potential homeowners, especially those in high-cost states. MBA also opposes the proposal to tax carried interest at ordinary tax rates (as opposed to the capital gains rate, as it is taxed now), as it would discourage capital formation for lending.

MBA believes the Financial Crisis Responsibility Fee will reduce the availability and increase the costs of real estate loans to consumers and small businesses by discouraging large financial institutions from entering into new, private label commercial mortgage backed securities (CMBS) and residential mortgage backed securities (RMBS) transactions and significantly reducing the profitability of non-agency servicing.

Story also noted that the budget did not offer any indications of the Administration's plans for the future of Fannie Mae and Freddie Mac.

"MBA has been at the forefront of the debate over the future of the government's role in the secondary mortgage market," said Story. "We rolled out our proposal in September and have been meeting with all stakeholders on Capitol Hill, within the administration, and across the industry to share our perspectives. Our proposal would provide a new foundation for supporting the core of the mortgage market. We look forward to continuing our discussions as the administration readies its suggestions."

MBA has supported the administration's efforts to improve risk management of the Federal Housing Administration's (FHA), and thus strongly supports the additional $18 million budgeted to allow FHA to implement its improved risk management systems. MBA also supports the $20 million budgeted to combat predatory lending and mortgage fraud at HUD, as well as additional funding for housing counseling and foreclosure avoidance.

"We are pleased to see increased funding for several critical programs at FHA," added Story. "We support both the efforts to help FHA better manage its risk. We also support additional funding at HUD and the Department of Justice to combat mortgage fraud. I also want to add how pleased I am to see that FHA's multifamily programs are continuing to show strong performance in the face of the current challenges in the housing market."

MBA also found troublesome the following additional provisions in the budget proposal:

- Termination of program authority to allow expensing (for tax purposes) of real estate environmental remediation, or "brownfields" clean up costs.

- Reduced federal support for terrorism risk insurance programs (TRIA).

---------------------------------------------------------------------------------------------------------