The Mortgage Bankers Association (MBA) reported on Tuesday that commercial mortgage originations were at a higher level during the last quarter of 2009 than in either the previous quarter or in the 4th quarter of 2008, but multifamily originations continued to lag. The data was part of the MBA's Quarterly Survey of Commercial/Multifamily Bankers Originations.

Commercial and Multifamily originations in the October-December 2009 period were 12 percent higher than those recorded June through September. Among investor types, loans from commercial banks increased 39 percent and life insurance companies increased originations by 35 percent. Conduits for Commercial Mortgage Backed Securities (CMBS) decreased by 50 percent and those from GSEs dropped 15 percent.

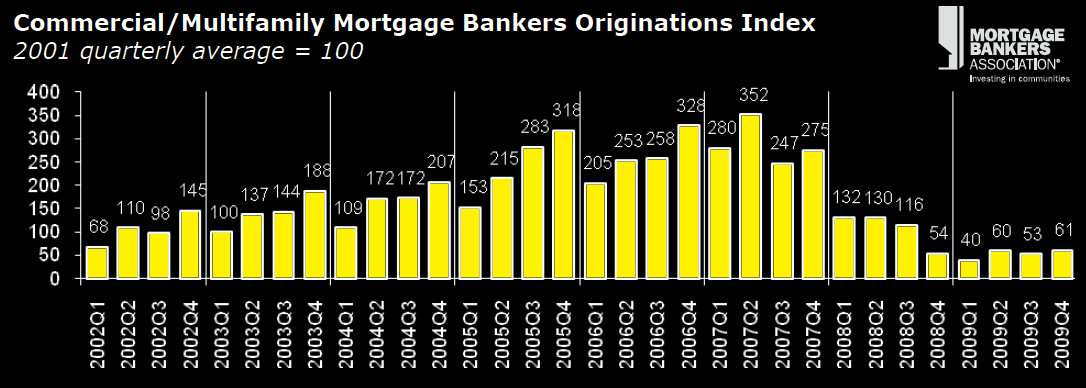

Below is a chart of the commercial/multifamily originations index. As you can see, relative to recent history, the index is still well below averages.

Loans for health care properties were up 58 percent and retail properties 34 percent. Loans for hotel properties were up 30 percent, industrial properties 19 percent. However multifamily properties saw an increase of only 4 percent and office properties decreased 12 percent.

Average loan sizes also increased from the third to fourth quarter. The average loan size overall increased from $9.9 million to $11.0 million. The average commercial bank loan was $8.2 million compared to $6.4 million and life insurance companies lent $15.6 million compared to $12.4 million. Loan sizes decreased from $18.2 million to $12.4 million for CMBS conduits and from $14.8 to $13.8 million for Fannie Mae and Freddie Mac.

Across property types, hotels were the big winners. The average loan was $35.3 million in the third quarter and $48.7 million in the fourth. Loans for health care properties nearly doubled from $5.9 million to 10.7 million on average. The average loan size decreased only for multifamily properties, going from $12.9 million to $12.4 million.

Originations during the recent quarter of 2009 were 15 percent higher than experienced during the same period in 2008. The increase was driven primarily by life insurance companies which saw an increase of 112 percent compared to one year ago. Commercial banks increased by 17 percent but CMBS conduits and the GSEs decreased by 82 percent and 26 percent respectively.

Lending to hotel properties increased by 105 percent over the year and retail lending was up by 101 percent. Loans for industrial properties, office properties, and health care properties increased by 59 percent, four percent, and 1 percent respectively. Loans for multifamily properties were down 8 percent.

"Commercial and multifamily mortgage originations picked up in the fourth quarter, but remain at a low level in absolute terms," said Jamie Woodwell, Vice President of Commercial Real Estate Research at the MBA. "The trend shows stability coming back to the market, but the pick-up in volumes really indicates just how low origination levels had fallen."