The National Association of Realtors this morning released December Pending Home Sales data.

A sale is listed as "pending" when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing. The index is based on a large national sample, typically representing about 20 percent of transactions for existing-home sales. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity from 2001 through 2004 parallels the level of closed existing-home sales in the following two months. Mortgage and Real Estate professionals know that a signed contract is just the first step in a long process nowadays though. The hard part is qualifying and closing!

Pending Home Sales, Housing Starts and Building Permits are considered more forward looking/timely than other housing indicators like Existing Home Sales. However it should be noted that Pending Home Sales are not as forward looking as Housing Starts and Building Permits.

PREVIOUS RELEASE: November Pending Home Sales

In November, the pending home sales index fell more than expected to 96.0 from a revised higher read of 114.3 in October. This was a 16.0 percent decline, much worse than the 2.0 percent contraction economists had forecast

CURRENT RELEASE: December Pending Home Sales

Consensus Forecast: Modest +1.0% rebound

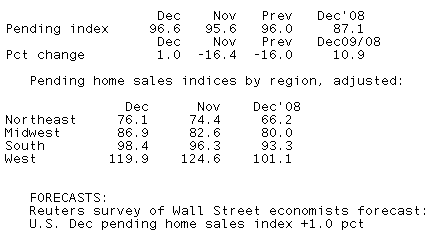

Actual: "On the screws" at +1.0% to 96.6. November was revised lower from -16.0% at 96.0 to -16.4% to 95.6.

Economists were expecting to see a small rebound in December Pending Homes Sales following a 16.4% decline in November, they got exactly what they were anticipating. The Pending Home Sales Index increased 1.0 percent to 96.6 from a revised for the worse read of 95.6 in November. This is 10.9 percent above December 2008 when it was 87.1.

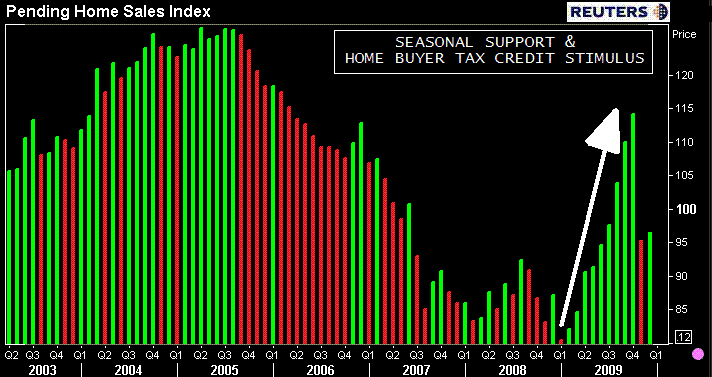

The chart below graphs the Pending Home Sales Index. I highlighted months of growth in GREEN and months of contraction in RED. Notice the decline in November put a halt to nine consecutive months of growth (which was a function of seasonal support and government stimulus). The rebound in December was small but not unexpected.

Pending Home Sales Regionally...

- Northeast: +23 percent to 76.1 in December and is 14.9 percent higher than December 2008.

- Midwest: +5.2 percent to 86.9 and is 8.7 percent above a year ago.

- South: +2.2 percent to an index of 98.4, and are 5.5 percent higher than December 2008.

- West: -3.8 percent to 119.9 but is 18.6 percent above a year ago.

Here is a table recapping the data:

Lawrence Yun, NAR chief economist, said it’s important to recognize how the tax credit is skewing market data.

“There are easily understood swings in contract activity as buyers respond to a tax credit that was expiring and was then extended and expanded,” he said. “These swings are masking the underlying trend, which is a broad improvement over year-ago levels. December activity was the fifth highest monthly tally in two years.”

Yun projects the extended and expanded tax credit will encourage 2.4 million households to take the credit in 2010. “While new-home sales will remain low due to a lack of construction, existing-home sales are projected to rise to around 5.6 million in 2010,” Yun said. Last year there were 5.16 million existing-home sales.

He added that one of the greatest benefits of rising sales will be firming home prices. “For several months now we’ve been seeing stabilization in all of the home price measures as inventory is pulled down,” Yun said. “As a result, the housing wealth for many middle class families has begun to stabilize.”

The debate on the future of housing continues to rage on. Some analysts point toward higher rates as a recovery killer, now others are starting to see that credit underwriting regs are too tight.

At the moment mortgage rates are holding at aggressive levels, yet loan demand from consumers remains muted (READ MORE). This implies the pool of qualified borrowers has shrunk considerably as many qualified homeowners refinanced in the first half of 2009 when rates were below 5.00%.

Looking forward...

While low mortgage rates were quite helpful in lowering the payments of millions of Americans (more disposable income), it appears rates are no longer the most important issue at hand for the health of housing. Overtightened underwriting guidelines should take center stage in the media. The question everyone will be asking: SHOULD FANNIE, FREDDIE, AND GINNIE BE LOOSENING CREDIT REGS WHEN HOUSEHOLD BALANCE SHEETS ARE SO VULNERABLE? Wouldn't that be irresponsible lending?

In the primary market we have a consumer demand problem which creates a supply shortage in the agency MBS market. This should keep mortgage rates from skyrocketing, but does that really matter anymore? How do we fix the consumer demand problem?

JOBS.