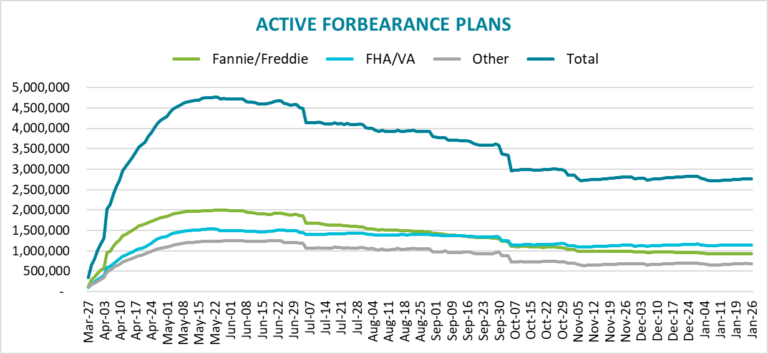

While the number of Fannie Mae and Freddie Mac (GSE) loans in forbearance continued to decline last week, that 4,000 loan improvement was more than offset by an increase in FHA and VA loan and loans serviced for bank portfolios and investors in private label securities (PLS).

Black Knight said the result was an increase of 20,000 loans in active forbearance plans during the week ended January 26. This, the company said, continues the trend of mid- and late month increases that has been apparent for some time.

At the end of the reporting period there were an estimated 2.76 million loans in forbearance, 5.2 percent of the nation's 53 million active mortgages and representing $551 billion in unpaid principal. After the 4,000-loan decline, 925,000 GSE loans, 3.3 percent of the total, remain in forbearance. FHA and VA portfolios added an aggregate of 9,000 plans, bringing those totals to 1.149 million or 9.5 percent of their loans. Bank/PLS plans grew by 15,000 to a total of 690,000 or a 5.3 percent share.

There was a total of 41,000 homeowners who exited forbearance plans during the week, one of the three lowest weeks since the recovery began. Another 172,000 plans are scheduled to expire at the end of this month.

Black Knight also notes that, while nearly half of homeowners had continued to make monthly payments early in the pandemic, that number has slowly declined to 12 percent in recent weeks.