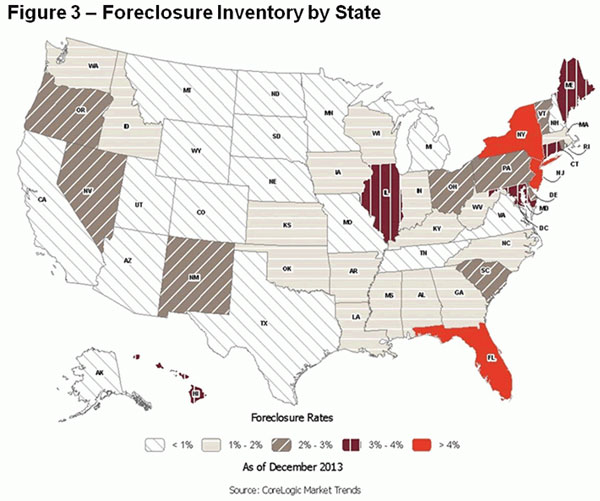

Completed foreclosures dropped by nearly a quarter in 2013 compared to 2012 CoreLogic said today. There were 620,111 homes foreclosed by lenders during the year compared to 820,498 in 2012, a decrease of 24 percent. Since September 2008, the date usually used to mark the beginning of the housing crisis, there have been approximately 4.8 million homes lost to foreclosure.

CoreLogic's National Foreclosure Report for December says there were 45,000 completed foreclosures during the month, down 14 percent from 52,000 from December 2012 and a 4.1 percent decrease from the 47,000 foreclosures completed in November. By way of comparison, the company said there were an average of 21,000 completed foreclosures a month in the more typical period between 2000 and 2006.

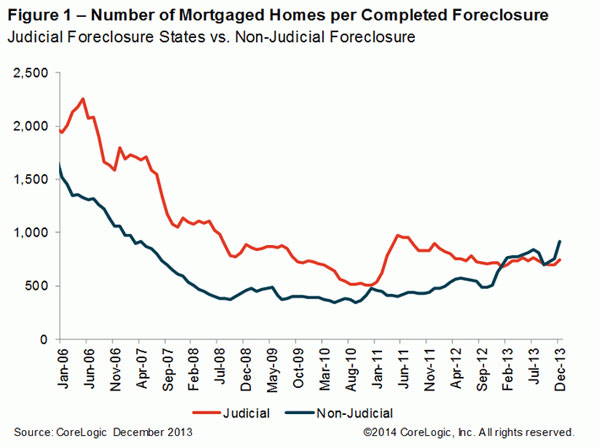

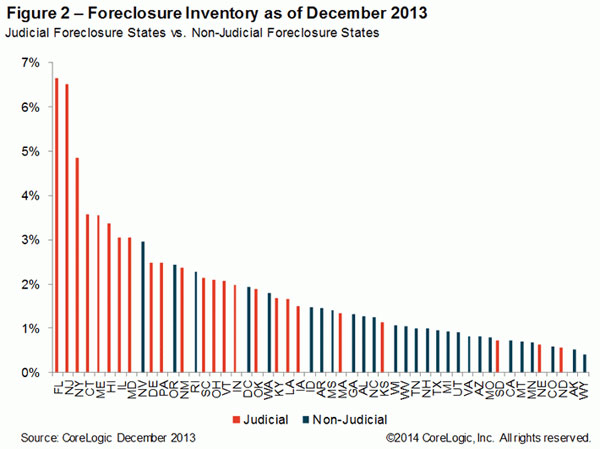

Approximately 837,000 homes nationwide were in some stage of foreclosure during the month of December, representing 2.1 percent of mortgage homes. This is a 31 percent reduction in the so-called foreclosure inventory which consisted of 1.2 million properties a year earlier, 3.0 percent of homes with a mortgage.

The foreclosure inventory fell by more than 30 percent in December on a year-over-year basis, twice the decline from a year ago," said Mark Fleming, chief economist for CoreLogic. "The decline indicates that the distressed foreclosure inventory is healing at an accelerating rate heading into 2014."

Five large states accounted for nearly half of the 600,000 plus completed foreclosures in 2013. Florida led with 119,000 followed by Michigan (53,000), California (39,000), Texas (39,000) and Georgia (35,000). States with the highest foreclosure inventory as a percentage of all mortgaged homes were Florida (6.7 percent), New Jersey (6.5 percent), New York (4.9 percent), Connecticut (3.6 percent) and Maine (3.6 percent).

In a press release accompanying the report Anand Nallathambi, president and CEO of CoreLogic said, "Clearly, 2013 was a transitional year for residential property in the United States. Higher home prices and lower shadow inventory levels, together with a slowly improving economy, are hopeful signals that we are turning a long-awaited corner," said. "The housing market should continue to heal in 2014, but we expect progress to remain very slow."