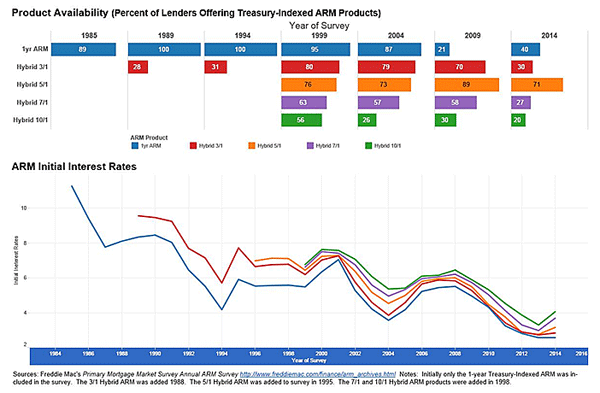

Adjustable rate mortgages remain at historic lows Freddie Mac said today as the company released results of its 30th Annual Adjustable-Rate Mortgage (ARM) Survey of prime loan offerings. The 1-year ARM has remained essentially unchanged since last year's survey while initial period rates on hybrid loan products rose. This, Freddie Mac said, largely reflects term structure movements in the rest of the capital markets and the Federal Reserve's monetary policy, which has kept the federal funds rate and other short-term interest rates exceptionally low while allowing a rise in medium- and longer-term interest rates from last year.

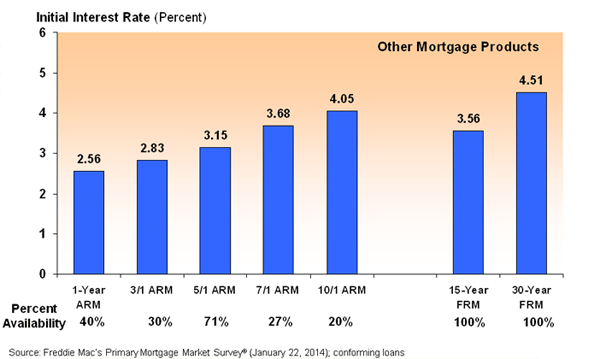

Hybrid ARMs have a fixed rate for an initial period ranging from three to 10 years and then adjust annual thereafter. Nearly all of the ARM lenders participating in the survey offered a hybrid with the 5/1 far and away the most common of the products both in terms of availability and use, followed by the 3/1, the 7/1 and the 10/1. Less common are ARMs with longer repricing periods such as a 5/5 which features rate adjustments every five years for the life of the loan.

The survey, which was conducted January 6 to January 10, showed that the largest rate increases were for hybrids with longer initial fixed-rate periods. The 7/1 ARM rose by 0.71 basis points from last year and the 10/1 was up 0.76 basis points.

The savings in early January 2014 for a borrower taking a 30-year 5/1 hybrid ARM instead of a 30-year fixed rate mortgage (FRM) was about 1.36 percentage points. This would result in a monthly principal and interest payment during the first five years that is about $194 less than for the fixed rate for a $250,000 loan.

Frank Nothaft, Freddie Mac vice president and chief economist said, "Homebuyers have preferred fixed-rate mortgages the past few years because of the low interest rates and the certainty of the monthly principal and interest payment. As longer-term rates rise, ARMs with their lower initial interest rates will become more appealing to loan applicants. Hybrid ARMs are particularly attractive because they have an initial extended fixed-rate period of 3 to 10 years."

Freddie Mac surveyed 106 ARM lenders and found that 84 offered ARMS indexed to Treasury bills and 22 offered London Interbank Offered Rate (LIBOR)-indexed ARMs. The company said that generally large national lenders offered LIBOR based loans while community and regional lenders were more likely to offer those based on Treasury indices. Thus, even though offered by fewer lenders, the LIBOR-based product accounted for more than one-half of ARM originations. LIBOR-indexed ARMs generally had a lower margin (about 0.5 percentage points lower) than Treasury-indexed ARMs, a similar initial interest rate, but a higher index rate (about 0.5 percentage points higher).