Mortgage performance understandably deteriorated over the course of 2020. Black Knight, in its "first look" at December data, noted that the year ended with 1.54 million more delinquent mortgages and 1.7 million more that were seriously delinquent than at the start, calling it "a looming reminder of the challenges facing the market in 2021."

The situation did continue to improve as the year ended. The national delinquency rate fell 3.9 percent from November to December and the resulting rate of 6.08 percent of all active loans was the lowest since April 2020 when the financial effects of the pandemic kicked in. It is however, nearly 79 percent higher than the rate at the end of 2019.

Serious delinquencies, loans 90 or more days past due but not in foreclosure, also declined, dropping by 47,000 loans to 2.146 million loans. In December 2019 there were 1.719 million such loans.

There were 7,100 foreclosure starts during the month. Foreclosure moratoriums are still in effect and are probably affecting those numbers, but the December starts, while an increase of 62 percent from November, were down 82 percent from the prior December. Completed foreclosures for the entire year numbered 40,000 an annual decline of more than 70 percent.

A total of 3.251 million loans were 30 or more days past due but not in foreclosure, down 130,000 month-over-month but 1.448 million more loans than were non-current a year earlier. Loans in process of foreclosure total 178,000, 2,000 more than the prior month but 67,000 fewer than the inventory in December 2019. That decline is probably also an artifact of the moratoriums.

The states with the highest rates of non-current loans in December were Mississippi, Louisiana, Hawaii, West Virginia, and New York. All had rates above 8 percent.

Prepayment activity remains strong, probably most because of high levels of refinancing. The single month mortality (SSM) rate of 3.15 percent was up 11.7 percent from November and 112 percent above the SSM at the end of 2019.

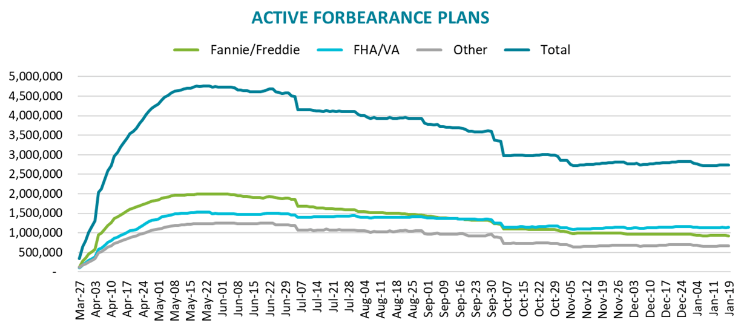

The company also released its weekly report on mortgage forbearances covering the period ended January 19. As has become common over the course of the program, the number of active plans tends to increase mid-month and did so last week, growing by 17,000. The number is, however, down 2.1 percent from the previous month. There were 2.74 million homeowners in forbearance at the end of the reporting week, representing 5.2 percent of all active mortgages and unpaid principal balances totaling $548 billion. Black Knight says the total number of active plans has been vacillating between 2.71 and 2.83 million since early November when the number of CORVIN-19 cases began to rise along with shutdowns.

Removal rates have also slowed noticeably following the six-month point of forbearance plans. This suggests that borrowers who remain in forbearance are likely more heavily impacted by the economic downturn and thus are less likely to leave such plans before the full allowable 12-month period ends.

A weekly decline of 3,000 Fannie Mae and Freddie Mac (GSE) loans in forbearance was more than offset by a 15,000 increase in plans among portfolio-held and private label securitized (PLS) mortgages and a 5,000 more FHA/VA loans. Active plans now represent 3.3 percent of total GSE portfolios, 9.4 percent of FHA and VA loans and 5.2 percent of those serviced for PLS and bank portfolios.

Black Knight concludes, "Though we are a far cry from the peaks we saw last summer as far as the total number of active forbearance plans, the rate of improvement continues to be relatively slow. We're seeing fewer new plan starts, with that number holding steady at the three-week average and down 30 percent from the same week in December. At the same time, plan removals remain weak, with this week recording the second lowest weekly removal volume observed to date since we began monitoring the situation in April."

The company will provide more in-depth information on December loan performance in its Mortgage Monitor. It will be published on February 1.