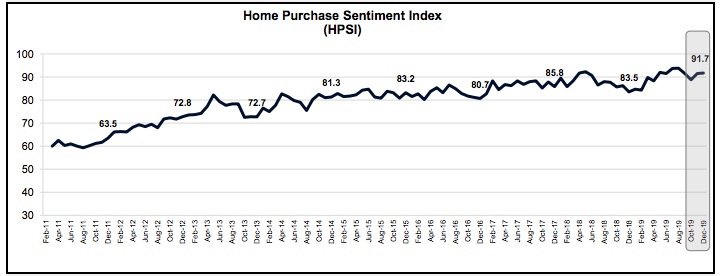

Fannie Mae's Home Purchase Sentiment Index (HPSI) finished out the year with little change from November to December, but with a strong increase over the December 2018 version. Three HPSI components were up in December but those gains were offset by losses in the other three resulting in only an 0.2 percent uptick for the month to a reading of 91.7.

The largest month-over-month gain was in the net share of those who expect home prices to rise over the next 12 months. The percentage of Americans holding that sentiment increased from 44 percent to 50 percent while 10 percent expect a decline, the same as in November. This left the net of those expecting increases 6 points higher points at 40 percent.

The net share of Americans who say mortgage rates will go down over the next 12 months fell 4 percentage points to a net negative of 32 percent.

The percentage of Americans who say their household income is significantly higher than it was 12 months ago remained the same at 28 with 10 percent reporting lower income (down 1 point) while those who reported no change was flat at 60 percent. The net share of Americans who are not concerned about losing their job over the next 12 months rose 2 points to 74 percent.

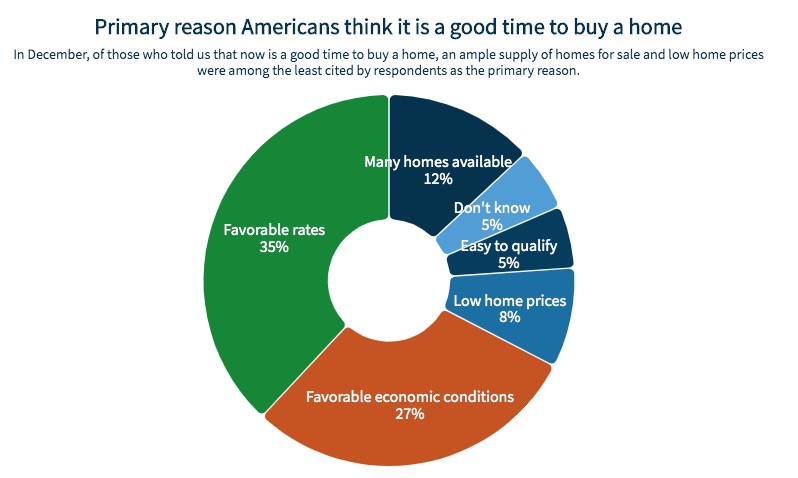

The largest monthly loss was in the net percentage of respondents who think it is a good time to buy a home. Those who said it is a good time decreased from 62 to 59 percent while the share who said it is a bad time increased from 29 percent to 32 percent. As a result, the net positive responses fell 5 points to 27 percent.

Sentiment about selling held up better. While the share of consumers who say it is a good time to sell dipped 1 point to 65 percent, those who viewed it as a bad time fell from 26 percent to 22 percent, leaving net positive responses up 3 points compared to November at 43 percent.

The year-over-year changes were much more dramatic. The overall index rose 8.2 percent compared to December 2018 with the only annual declines a net 5-point loss in those who were unconcerned about losing their job and a 1-point decrease in those reporting higher income. At the same time the net share of those expecting lower interest rates gained 24 points an those expecting higher home prices rose 9 points. Good time to buy and good time to sell sentiments grew a net of 16 points and 7 points respectively.

The December survey asked respondents why they considered the current market a good time to buy. Favorable interest rates was the most frequent response while an ample supply of homes for sale and low home prices were cited the least.

"The continued strength in the HPSI attests to the intention among consumers to purchase homes. This is consistent with the Fannie Mae forecast for 2020," said Doug Duncan, Senior Vice President and Chief Economist. "The HPSI hit and remained near an all-time high in 2019, driven by the 16-percentage point year-over-year increase in the share of consumers believing it is a good time to buy. The HPSI's strength supports our prediction of a healthy housing market in 2020, as well as consumers' appetite and ability to absorb the expected increase in entry-level inventory."

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that form the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts. The December 2019 National Housing Survey was conducted between December 1 and December 19, 2019.