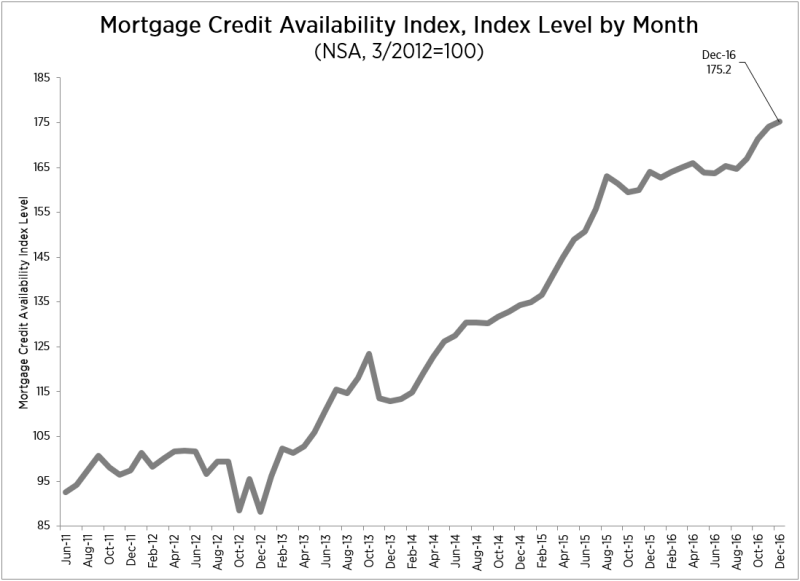

Access to credit continued to inch up last month according to the Mortgage Bankers Association's (MBA's) Mortgage Credit Availability Index (MCAI). The index rose 0.6 percent to 175.2 in December. An increase in the index indicates that lending standards are loosening.

Lynn Fisher, MBS's Vice President of Research and Economics said, "Credit availability was up for the fourth consecutive month in December driven by jumbo loan programs as well as loan programs for borrowers with lower credit scores and low down payments."

Of the four component indices, the greatest increase, as noted by Fisher, was in the Jumbo MCAI which rose 1.3 percent. The Conventional MCAI increased by 0.7 percent, the Government MCAI by 0.6 percent, and the Conforming component by 0.04 percent.

The MCAI and its components are calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA and analyzed using data made available via Ellie Mae's loan application data base. The MCAI, Conforming, and Jumbo indices have a base level of March 2012=100. The Conventional and Government indices have adjusted "base levels" in March 2012, calibrated to better represent where each index might fall in March 2012 (the "base period") relative to the Total=100 benchmark.