Refinancing activity has probably held up better than expected as interest rates have risen. Refinance applications accounted for more than 40 percent of the total in each of the Mortgage Bankers Association's weekly application volume summaries in December, aided by an unexpected dip in rates. But CoreLogic's chief economic Frank Nothaft is predicting a dim future for that part of the business.

In his Economic Outlook for January, Nothaft says he expects mortgage rates to reach their highest levels in a decade this year, affecting home buyers' monthly payments and lessening the impact of new conforming loan limits. But the larger effect will be on refinancing. Millions of homeowners have already refinanced into the record low rates over the last few years, and they, as well as those who have purchased during the same period, are unlikely to refinance unless they need to cash out some of their home equity.

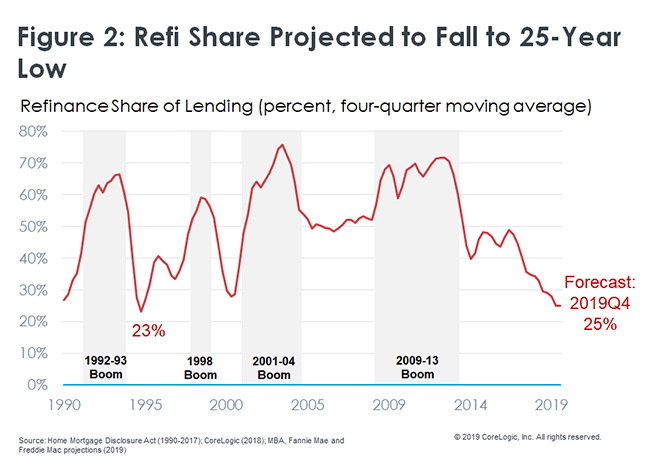

He used CoreLogic data to calculate the distribution of outstanding single-family mortgage debt by interest rate and found only 3 percent of the total in mortgages with a rate of 6 percent or more, a total outstanding debt of about $300 billion. He speculates that these homeowners have not refinanced because of insufficient equity, credit problems, or small balances; the average loan size was about $100,000.

There are indeed reasons other than rates for homeowners to refinance. Nothaft says some 500,000 FHA-backed mortgages were refinanced into conventional mortgages in the two years ended last September. These refinances allow homeowners with good credit and 20 percent equity or more to eliminate FHA insurance premiums which otherwise continue through the life of the loan. Extracting equity after the strong run-up in home prices over the last few years will probably prompt a certain amount of cash-out refinancing as well. In fact, CoreLogic data shows that those refinances exceeded 40 percent in the third quarter of last year and Nothaft says he expects that number to increase.

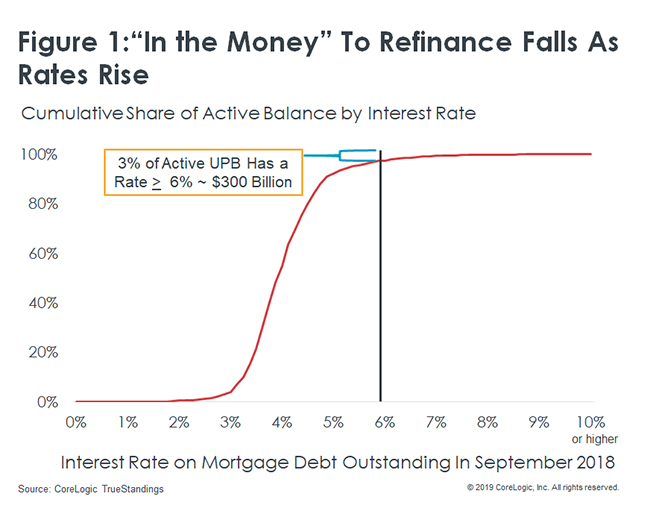

Despite these types kinds of incentives, he is forecasting that the refinance share of originations will decline to about 25 percent of lending dollar volume this year. That will be the lowest four-quarter share since mid-1994 to mid-1995 when refinancing accounted for 23 percent of originations. Still, he expects that increases in purchase lending will fill the gap, leaving the dollar volume of originations in 2019 at about the same level as last year.