Freddie Mac is dismissing concerns of some analysts that the change in the Federal Reserve's monetary policy may bode ill for the housing industry. The company's vice president and chief economist Sean Becketti welcomed the New Year with an upbeat rebuttal of those concerns on Freddie Mac's Executive Perspectives blog.

Becketti said that he does not share the worries about the December hike in the fed funds interest rates boosting mortgage rates, reducing home affordability, or reversing the recent improvements in housing numbers. He cites several reasons for his view.

The Federal Reserve is aware that the economic recovery remains fragile and has committed to a policy of gradual monetary tightening. They should be taken at their word, Becketti says, and we should expect only a few modest increases in short-term rates this year.

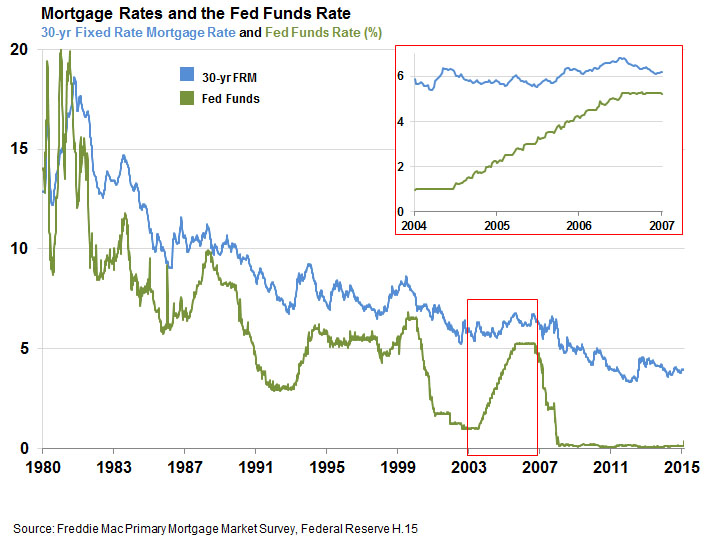

Further, the connection between short-term rates controlled by the Fed and long-term rates including those for mortgages is "tenuous." He cites the example of the 17 consecutive monthly rate hikes made by the Fed in the mid-2000s. They had virtually no effect on mortgages rates which remained around 6 percent.

The weak global economy will continue to attract money to Treasury securities from around the world, limiting longer-term interest rates while the strong dollar and falling oil prices will hold U.S. inflation down. This will provide further incentives for the Fed to only gradually and cautiously increase monetary tightening.

Becketti does see long-term rates beginning to move up this year as monetary tightening starts to impact economic activity but those rates will move only fractionally compared to short-term rates. However, he says, even a modest increase in mortgage rates will cut home affordability, especially for first-time and low-to-moderate income homebuyers and this may restrain house price increases at the lower-priced end of the market.

This could change should the Fed begin to reduce the size of its mortgage-backed securities (MBS) portfolio obtained through the various quantitative easing (QE) programs. This could drive long term rates up sharply but the concept is at odds with the Fed's public commitment to gradual easing. "We don't expect the Fed to shrink the QE portfolio until the latter part of 2016 at the earliest, and any significant reduction in the QE portfolio isn't likely until 2017," he says.

Becketti's optimism about the impact of Fed actions on housing does not extend to the economy as a whole. The Fed seems to believe the healing of the country's macro economy is on track but he sees its performance since the recession as by far the weakest since the post-World War II era and productivity appears to have declined to the point that there will be only 2 to 2.5 percent real growth.

Summing up his housing predictions for 2016, he sees mortgage rates increasing only gradually from year end 2015's 4.1 percent to an average of 4.4 percent this year. While short inventories will continue to boost home prices, gains will moderate, partially in response to the reduction in affordability, to around 4.4 percent this year.

Home sales will continue to improve, up by about 3 percent in 2016 but home construction will do even better with housing starts rising by 16 percent. While single-family homes will account for most of the increase rental apartment construction will grow as well - although not enough to meet the growing demand coming from both older and younger age groups.

Despite an increase in home purchases, mortgage originations will decline along with the volume of refinancing. He is looking for about $1.58 trillion in origination volume compared to the projected $1.75 trillion in 2015. That year-end projection has been revised upward largely due to higher-than-expected refinance activity which even after years of sustained low interest rates, has remained high. Becketti says the volume of refinances may continue to exceed expectations despite mortgage rate increases, especially if the share of cash-out refinances continues to grow.