In a letter to the chairs and ranking members of the Senate Banking and House Financial Services Committees on Wednesday, Federal Reserve Chairman Ben S. Beranke said "Restoring the health of the housing market is a necessary part of a broader strategy for recovery." The letter accompanied a white paper developed by the Fed which Beranke called a "framework for thinking about certain issues and tradeoffs that policymakers might consider."

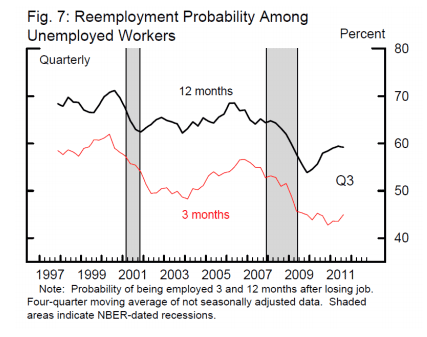

In its opening pages the white paper titled The U.S. Housing Market: Current Conditions and Policy Considerations acknowledges that much of the weakness in the housing market is related to poor labor market conditions and will take time to be resolved but outlines three dimensions along which policymakers could take action to ease some of the pressures on the housing market:

1. Moderating the inflow of properties into the large inventory of unsold homes

The large inventory of foreclosed or surrendered properties (REO), perhaps representing one-quarter of the 2 million vacant homes for sale in the second quarter of 2011, is putting downward pressure on house prices, and exacerbating the loss in household wealth. The continued influx of new REO, perhaps as many as 1 million properties per year in 2012 and 2013, will continue to weigh on house prices for some time. To the extent that REO holders discount properties in order to sell them quickly, the near-term pressure on home prices might be even greater.

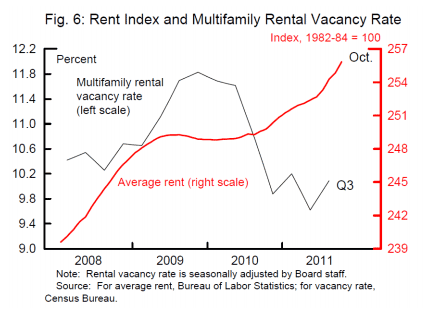

At the same time, strengthening rental markets in some areas are reflecting the decline in homeownership with vacancy rates falling and rents rising in many markets. The price signals in the markets, that is the decline in house prices and the rise in rents, suggest that it might be appropriate in some cases to convert foreclosed homes into rental properties and, at this time, with no indication that the downturn in homeownership being likely to reverse in the immediate future, there are indications of a longer-term need for expanded rental housing stock.

Although small investors are currently buying and converting foreclosed properties to rentals, this is a limited solution and larger-scale conversions have not occurred for at least three interrelated reasons. First, it can be difficult for an investor to assemble enough properties within a sensible geographic area to achieve efficiencies of scale. Second, attracting investors to bulk sales has typically required REO holders to offer significantly higher discounts relative to those given owner occupants, in part because it can be difficult to investors to obtain financing for such sales, and third, the supervisory policy of GSE and banking regulators has generally encouraged sales of REO properties as early as practicable.

Intertwined in these issues is the unresolved role of the government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac which, because of their outsized presences, affect not only their own holdings but the larger market with their actions. Despite the mandate of the Federal Housing Finance Agency (FHFA) as conservator of the GSEs to minimize taxpayer losses, some actions that cause greater losses to the GSEs in the near term might be advantageous if they lead to a quicker and more vigorous recovery. The paper presents a number of suggestions for dealing with inventory held by the three principal government related agencies while suggesting it will discuss properties held by federally regulated banks at a later date.

An REO to rental program that relies on sales to third-party investors will be more viable if the cost-pricing differential can be narrowed which might be done by (a) structuring sales as competitive auctions; (b) making sales packages more attractive to a variety of investors, or (c) providing investors with the debt financing. In the latter case REO holders could probably increase sales prices by providing financing but this may be at the cost of reducing their future income stream.

The paper also suggests some innovations for reducing the amount of time that a vacant property remains in inventory such as auctioning the rights to acquire a future stream of properties that might be foreclosed in a given neighborhood rather than auctioning existing REO holdings or to encourage deed-for-lease programs which circumvent the REO process entirely by exchanging a deed-in-lieu for a rent-back arrangement.

Another solution might be for the REO holder to convert the properties to rentals themselves. The value of this suggestion may become more apparent as the inventories increase. The paper also suggests that land-banking, perhaps with the assistance of federal subsidies, could be an option for low-value properties.

2. Remove some of the obstacles preventing creditworthy borrowers from accessing mortgage credit.

The paper touches only lightly on this topic, saying that the regulators have been in consultation with the GSEs and originators about the sources of the apparent tightness in lending standards and that balance is needed between prudent lending and appropriate consumer protection on one hand and not unduly restricting credit on the other.

3. Limit the number of homeowners who are pushed into an inefficient and overburdened foreclosure pipeline.

Beyond the personal suffering, foreclosures can be a costly and inefficient way to resolve mortgage payment obligations because they can result in "deadweight losses", i.e. costs that do not benefit anyone such as neglect and deterioration of properties and neighborhoods and the impact of that in putting additional downward pressure on prices. Some foreclosures might be avoided if loan modifications are pursued more aggressively and servicers given greater incentives to do so. Where modifications are not feasible there should be more expedient ways to exit from homeownership.

Many homeowners who could benefit from refinancing are unable to do so, and the paper credits recent changes in HARP with helping in this area but suggests possible further expansion to borrowers whose existing mortgages are not guaranteed by the GSEs even though this raises a host of risk management issues.

The Fed suggests changes to the HAMP loan modification program as well. One would be to eliminate the 31 percent debt-to-income (DTI) floor that currently exists in the program. Another is eliminating the focus on modifications for borrowers who have become unemployed, concentrating instead on payment deferment through the period of unemployment which might avoid permanent foreclosures arising out of a temporary situation.

The paper also suggests that the focus of HAMP on net present value to the lender is short sighted and there may be other types of modifications which may be socially beneficial even if not in the best interests of the lender. This, they concede, may be a tough sell to lenders and likely to involve more taxpayer funds.

Large scale modifications involving principal reduction may be too costly to consider. The paper calculates that the 12 million underwater mortgages in the country represent about $425 billion in negative equity and targeting underwater borrowers who are likely to default raises issues of fairness in addition to expenses. An alternative would be aggressively facilitating refinancing for underwater borrowers who are current on their loans, expanding modifications for borrowers who are struggling with payments, and providing a streamlined exit from homeownership for borrowers who want to sell their homes.

Expanding short-sale and deed-in-lieu opportunities have many advantages but the barriers to short sales include willing buyers at prices acceptable to the REO holder and a timeline that allows the transaction to close before the foreclosure. Deeds-in lieu are often not pursued because of complications such as junior liens, dealing with deficiency claims, and the burden of additional REO. On the other hand, borrowers may not even realize the existence of such an alternative and instead remain in their homes through the entire drawn-out foreclosure process. Figuring out ways to surmount these obstacles is crucial.

The paper also addresses the shortfalls in loan servicing that have been widely discussed and some of the solutions that have been proposed such as changing the compensation structure, making changes to the MERS registry, and better monitoring the servicers.

It is clear from the conclusion to the paper that the Fed is not just searching for short-term solutions to the current market disruptions, but a fundamental restructuring of the system so that these problems are better packaged for management in the future. "The challenge for policymakers is to find ways to help reconcile the existing size and mix of the housing stock and the current environment for housing finance. Fundamentally, such measures involve adapting the existing housing stock to the prevailing tight mortgage lending conditions or supporting a housing finance regime that is less restricting than today's while steering clear of the lax standards that emerged during the last decade."