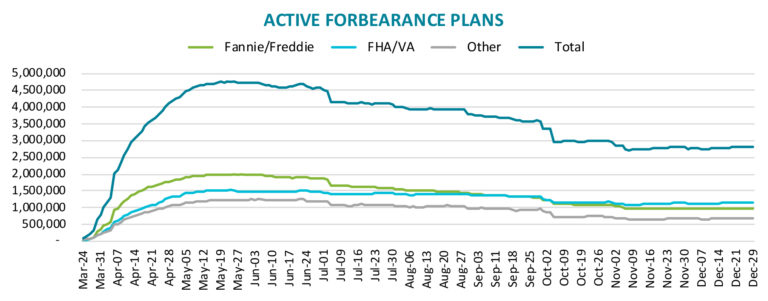

The number of loans in COVID-19 forbearance plans last week rose for the third consecutive week during the period ended December 29. Black Knight said a 15,000-loan increase in the number of forborne loans brought the total to its highest level since early November. However, despite three consecutive weekly rises, the number of active plans only stands 13,000 higher than the same point in late November.

Part of last week's increase was due to the limited number of loans removed from the rolls, the fewest since the start of the pandemic. A drop off in removals has been noted fairly consistently late in each month, but according to the company, may have been more pronounced during the holidays. There were nearly 270,000 plans due to expire at the end of December so the company says it is possible there will be a heightened number of removals during this coming week.

Forbearances totaled 2.83 million at the end of the reporting period. This is 5.3 percent of the 53 million active mortgages in the U.S. and represents as aggregate unpaid balance of $568 billion.

FHA/VA forbearances increased by 11,000 from the previous week, reaching a total of 1.164 million loans or 9.6 percent of those portfolios. Loans serviced for bank portfolios and private label securities (PLS) grew by 4,000 to 700,000 or 5.4 percent. Fannie Mae and Freddie Mac (GSE) forbearances were largely unchanged at 964,000 loans or 3.5 percent of their portfolios.

The number of forbearance plan starts were also down, hitting the lowest level since the start of the pandemic, another possible result of the holidays. Start volumes have now fallen in each of the last three weeks.