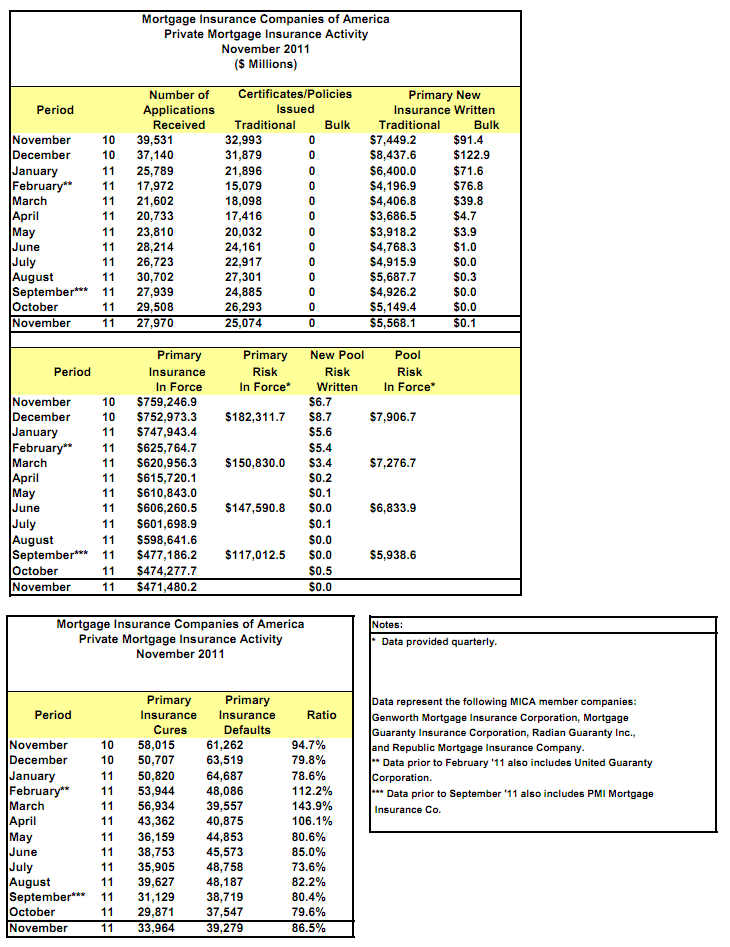

The major private mortgage insurers wrote 25,074 new policies in November against 27,970 applications received for coverage. According to the monthly statistical report on its member companies from Mortgage Insurance Companies of America (MICA), this was down substantially from October's book of business when 29,508 applications were received and 26,293 policies written.

MICA is the trade group representing Genworth Mortgage Insurance Corporation, Mortgage Guaranty Insurance Corporation, Radian Guaranty Inc., and Republic Mortgage Insurance Company. These are among the largest companies writing private mortgage insurance which is required for conventional loans when the down payment available for purchase or equity for refinancing results in a loan with less than an 80 percent loan-to-value.

Only monthly comparisons are feasible for the November data as one year earlier the much higher numbers included those of PMI Mortgage Insurance Company, now in receivership with the State of Arizona, and United Guaranty Corporation which is no longer reporting to MICA.

While the number of policies written on newly originated mortgages was down, their dollar volume increased in November to $5.6B compared to $5.1B in October. The company now has $471.4B of primary insurance in force compared to $474.2B in October and reported $117.0B in primary risk in force at the end of the last quarter.

MICA members reported 39,279 defaults during the month and 33,964 cures compared to October results of 37,547 defaults and 29,871 cures in October.