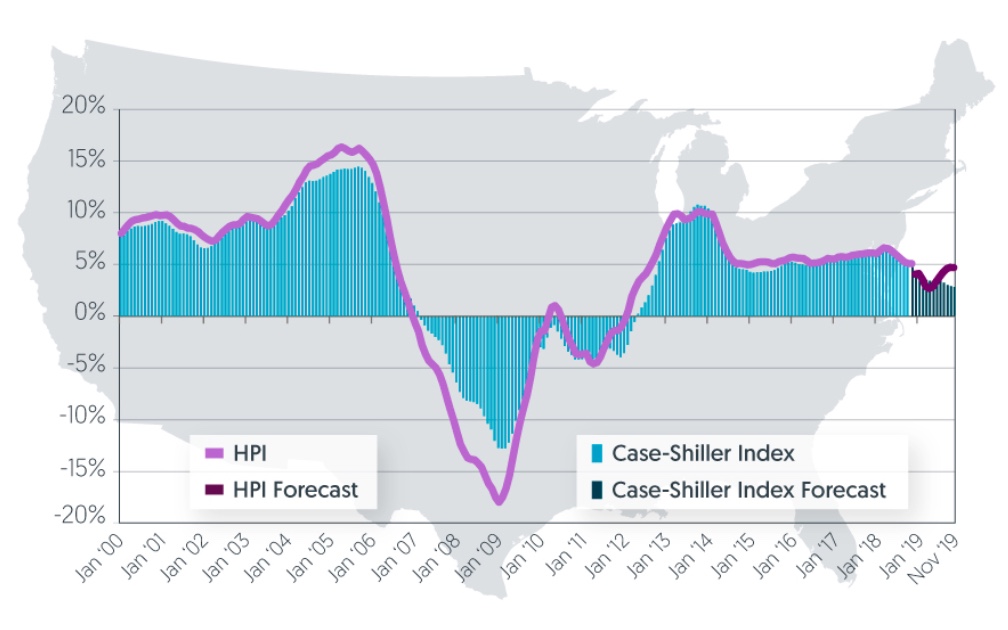

Home prices grew by an estimated 0.4 percent in November according to CoreLogic's Home Price Index (HPI) and were 5.1 percent higher than at the end of November 2017. These figures indicate a significant slowdown in the rate of appreciation nationally over the past year. The company reported a 1.0 percent gain for the month of November 2017 and, at that point, prices were up 7.0 percent year-over-year.

CoreLogic's chief economist Frank Nothaft said, "The rise in mortgage rates has dampened buyer demand and slowed home-price growth. Interest rates for new 30-year fixed-rate loans averaged 4.9 percent during December, the highest monthly average since February 2011. These higher rates and home prices have reduced buyer affordability. Home sellers are responding by lowering their asking price, which is reflected in the slowing growth of the CoreLogic Home Price Index."

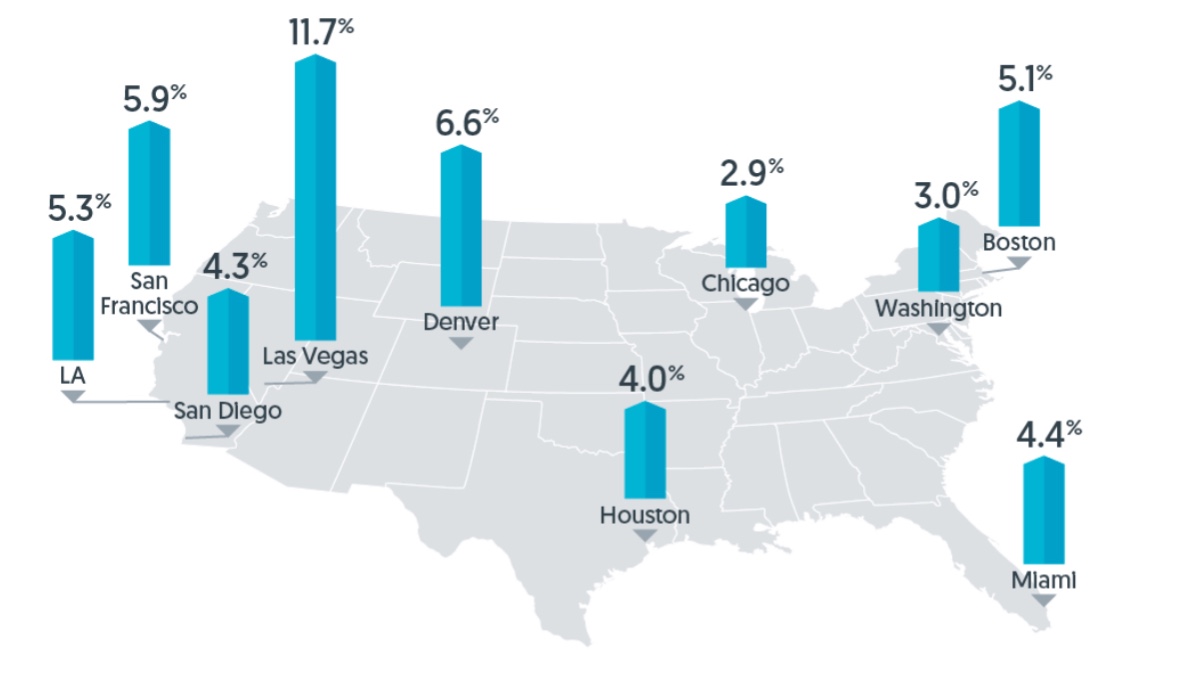

All states but North Dakota experienced increases since November 2017. The states with the highest increases year-over-year were: Nevada (11.1%), Idaho (11.0%) and Utah (8.8%). Las Vegas was the metro area with the highest rate of appreciation, 11.7 percent.

CoreLogic sees more than a third (35 percent) of the 100 largest metro areas as having prices at least 10 percent higher than their long-range sustainable levels; i.e. a level supported by local market fundamentals such as disposable income. In addition, 27 percent were undervalued, and 38 percent were at value. When looking at only the top 50 markets based on housing stock, 44 percent were overvalued, 18 percent were undervalued, and 38 percent were at value. An undervalued housing market is one in which home prices are at least 10 percent below the sustainable level.

Looking forward, the CoreLogic HPI Forecast indicates that home prices will increase by 4.8 percent on a year-over-year basis from November 2018 to November 2019 and is looking for a decline of 0.8 percent in the index from November to year end.

The graph below compares the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to the present month with forecasts one year into the future. The company notes that both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive but moderating year-over-year percentage changes, and forecasting gains for the next year.

The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

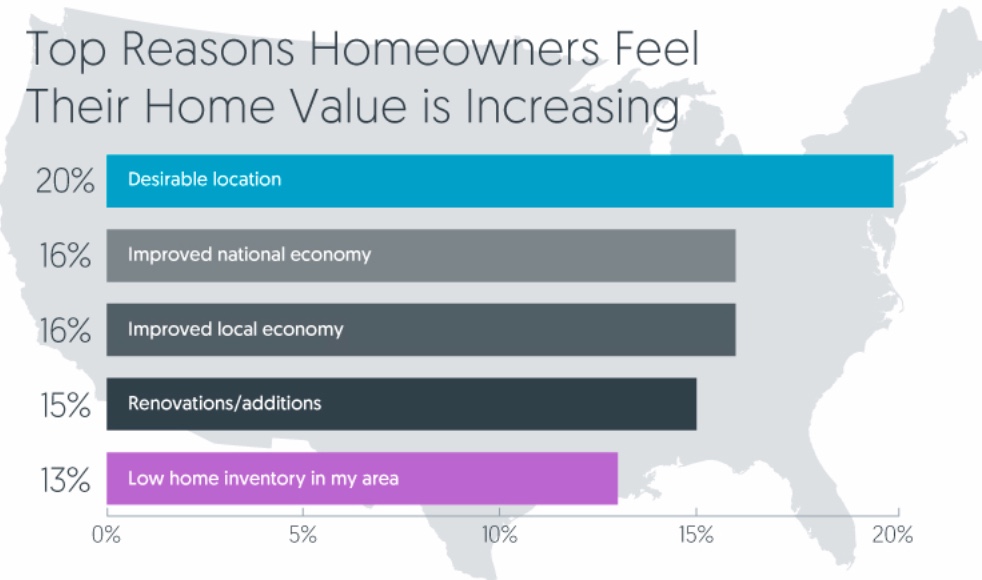

In 2018, CoreLogic and RTi Research conducted an extensive survey measuring consumer-housing sentiment; assessing attitudes toward homeownership and the driving force behind the decision to buy or rent a home. When homeowners were asked why they felt their home was increasing in value, they cited desirable location and improving local and national economies. As the country enters a new year, the state of these economic conditions will continue to impact attitudes toward homeownership and perceived property values.

Frank Martell, CoreLogic's president and CEO commented, "A strong economy helps homeowners feel confident about the value of their property. If recent declines in the stock market shakes consumer confidence in the national economy, we may see homeowners' perception of home value change and a subsequent buyers' market emerge in 2019."