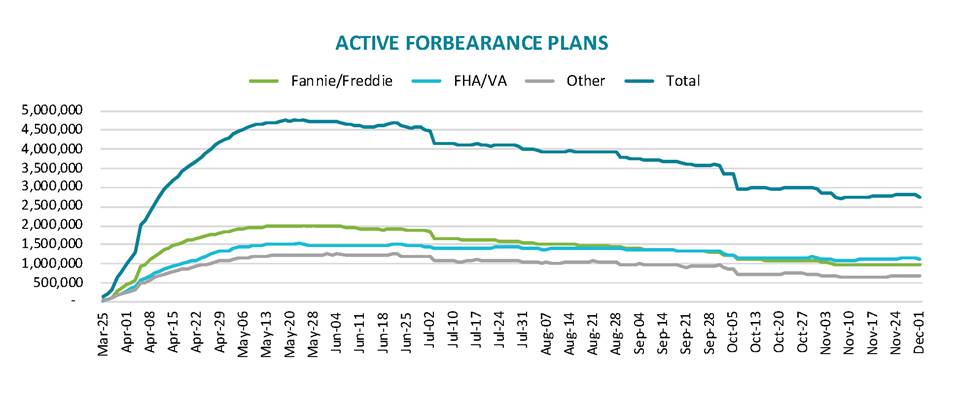

Mortgage forbearances for homeowners affected financially by the pandemic declined slightly over the past week. Black Knight said that there were 200,000 plans scheduled to expire at the end of November, probably accounting for the majority of the 39,000-loan downturn in the various forbearance programs. Another 1 million plans are due to expire at the end of this month.

As of December 1, there were a total of 2.76 million loans remaining in plans, 5.2 percent of the 53 million active mortgages in servicer portfolios and representing $561 billion in unpaid principal. Eighty-one percent of those loans have had their terms extended at some point since March.

The number of GSE (Fannie Mae and Freddie Mac) loans in forbearance dropped by 25,000 during the week, leaving a total of 967,000 homeowners remaining in plans. This is 3.5 percent of the companies' combined portfolios. FHA and VA loans decreased by 14,000 units to a total of 1.118 million or 9.2 percent of those loans. Loans serviced for bank portfolios or private label securities held steady at 677,000 loans or 5.2 percent of the total. There are 91,000 fewer loans in forbearance plans than one month ago, a 3.2 percent decline.

The remaining loans in forbearance require advanced principal and interest payments to investors of $3.4 billion per month. Payments for property taxes and insurance premiums add another $1.2 billion per month to the outflow.