Consumer sentiment about buying a house fell even further into negative territory in July. Fannie Mae said that only 28 percent of respondents to its monthly National Housing Survey thought it was a good time to buy while two thirds said it was not, continuing a deflation of buyer enthusiasm that began in early spring. The net positive responses fell 6 points from the June level to -38 percent, a full 53 points lower than in July 2020.

Responses to whether it was a good time to sell dropped 7 points to 75 percent, but it those responses had been on an upswing in previous months. That left net positive responses at 55 percent, 58 points higher year-over-year.

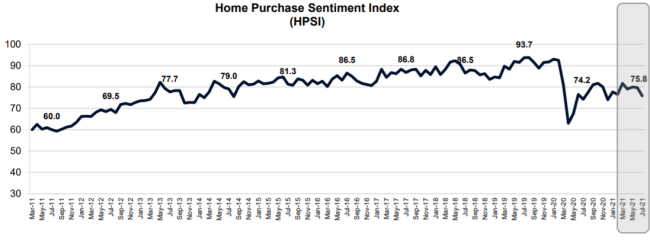

While the buying and selling questions usually attract the most attention, all six components of the index fell from their June levels. This brought Fannie Mae's Home Purchase Sentiment Index (HPSI) down 3.9 points to 75.8. The Index is 1.6 points higher than a year earlier.

"Historically prime homebuying groups appear to be increasingly sensitive to the lack of affordability, as home prices continue to increase and homes for sale remain in short supply," said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. "While all surveyed consumer segments have reported increased pessimism toward homebuying conditions over the past several months, two of the segments perhaps best positioned to purchase -- consumers aged 35-44 and those with middle-to-higher income levels - have indicated even more pessimism than other groups."

"Overall, the HPSI remains within a tight range established a few months after the onset of the pandemic in 2020. Consumer sentiment toward homebuying hit yet another survey low in July, continuing the sharp downward trend established in March. The percentage of respondents citing high home prices as the top reason for it being a 'bad time to buy' also reached an all-time high. On the flip side, selling sentiment remains extremely high, and well above pre-pandemic levels, for the same commonly cited reason: high home prices."

The percentage of respondents who say home prices will go up in the next 12 months decreased two points to 46 percent while 21 percent said they expect them to decline, unchanged from the prior month. The share who think home prices will stay the same increased from 25 percent to 27 percent resulting in a net of one quarter of responses expecting higher prices over the next 12 months.

Only 5 percent of consumers expect further declines in mortgage rates while 57 percent think they will go up, the same percentage as in June. Thirty-percent expect no change, up 1 point in a month. The net share of those expecting a decline dipped 1 point to -52 percent.

The percentage of consumers who are not concerned about losing their job fell 4 points in July to 84 percent, perhaps due to the resurgence of COVID-19 in some locations. The net who are unconcerned is up 18 points year-over-year to 71 percent

Those respondents who say their household income is significantly higher than it was 12 months ago remained unchanged at 27 percent while the percentage who say it is significantly lower increased from 13 percent to 14 percent and the percentage who said there was no change remained at 56 percent for a net of decline of 1 point.

The National Housing Survey from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that are the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts.