CoreLogic has been running a series of articles in its Insights blog attempting to quantify the potential impact of the expiration of the so-called GSE Patch. The Patch provides an exception to the 43 percent debt-to-income (DTI) ratio limit of the Qualified Mortgage (QM) rule for loans that are eligible for purchase or guarantee by one of the government sponsored enterprises (GSEs) Fannie Mae or Freddie Mac. The patch is due to expire in January 2021 and the Consumer Financial Protection Bureau has stated its intention to let it expire after a possible transitional extension.

In Part 1 CoreLogic's Pete Carroll estimated about 16 percent or $260 billion of 2018 mortgage loan origination volume was QM-eligible due to the GSE Patch. In the second installment Archana Pradhan reviewed borrowers age, income, employment type and home sales price in the high Debt-to-Income (DTI) group. She found the youngest and the oldest borrowers and those with non-traditional income sources would be hardest hit by the expiration. In Part 3 Pradhan focuses on borrower race/ethnicity and income categories, and those borrowers buying properties located in low-income and minority neighborhoods.

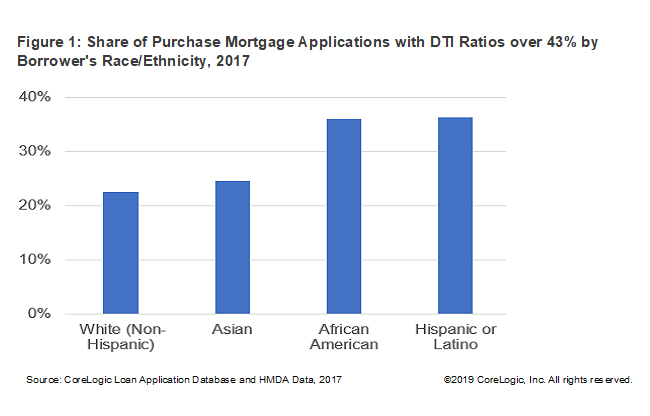

Using the most recent Home Mortgage Disclosure Act (HMDA) data, Pradhan found, the share of African American and Hispanic/Latino borrowers that applied for a loan in the GSE Patch was approximately 1.6 times higher than the share of non-Hispanic White and Asian borrowers based on 2017 data.

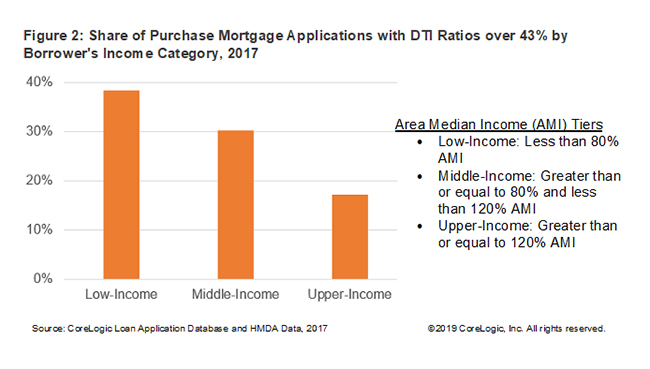

Probably not surprisingly, the share of GSE Patch loans is also higher among low-income borrowers than those of middle- and upper-income borrowers. Low-income borrowers accounted for the highest share of loans with high DTIs, followed by middle-income borrowers. The low-income were more than twice as likely as the upper-income borrowers to have over a DTI over 43 percent.

Those applicants who would currently fall in the Patch will only be able to apply for Non-QM loans after the patch expiration unless there is additional policymaking by the CFPB. Alternatively they might modify their financing choice (i.e. buying a lower priced home) in order to qualify under the regular QM rule.

The author also looked at whether homes purchased with Patch-enabled loans were more or less likely to be in an underserved area under the Federal Housing Finance Agency's (FHFA) Underserved Areas definition (a tract with a median income at or below 80 percent of the area median income (AMI)). She found borrowers buying a home located in a low-income neighborhood in 2017 accounted for a 30 percent share of above 43 percent DTI loans while only 25 percent were loans used to purchase a home in a middle- or upper-Income neighborhood.

Analysis by the minority composition of a neighborhood had similar results. A minority neighborhood is one with a minority population of at least 30 percent and a median income of less than 100 percent of the AMI. Thirty-two percent of purchase mortgage applications in those neighborhoods were high DSI loans compared to 25 percent in "other" neighborhoods.