Housing inventory shortages, lack of new construction, and the not-unrelated issues of rising prices and falling measures of affordability have been major topics of discussion and analysis for several years. Fannie Mae included some special questions in a recent edition of its National Housing Survey, probing for information as to whether respondents consider their current home affordable, the trade-offs they weigh when choosing housing - whether buying or renting - and how they balance housing expenditures with other needs and wants. The company also wanted to know if perceptions about affordability might be reducing household mobility and exacerbating the housing shortage.

According to Fannie Mae Chief Economist Mark Palim, one finding was that both homeowners and renters are more concerned about the affordability of any new housing than they are about their current residence. Only 8 percent of homeowners reported that their current mortgage is not affordable while 45 percent felt that affordable housing is difficult to find in their area and 44 percent felt that has been increasingly the case in the last few years. Fannie Mae said this gap may explain why homeowners are staying put in their current homes, contributing to the shortage of existing homes that are for sale.

Renters reported spending a larger portion of their income on housing than did homeowners; 32 percent versus 23 percent. Among renters, 19 percent found their current rent unaffordable. When renters are categorized by the type of property they rent, single family renters were more likely than those in multi-family properties to consider their rent manageable. Like homeowners, renters are far more positive about the affordability of their current home than other homes in the area; 56 percent said affordable rentals are hard to find, a perception Palim said may explain the growth in homeownership over the past two years and the importance of first-timers to the homebuying market.

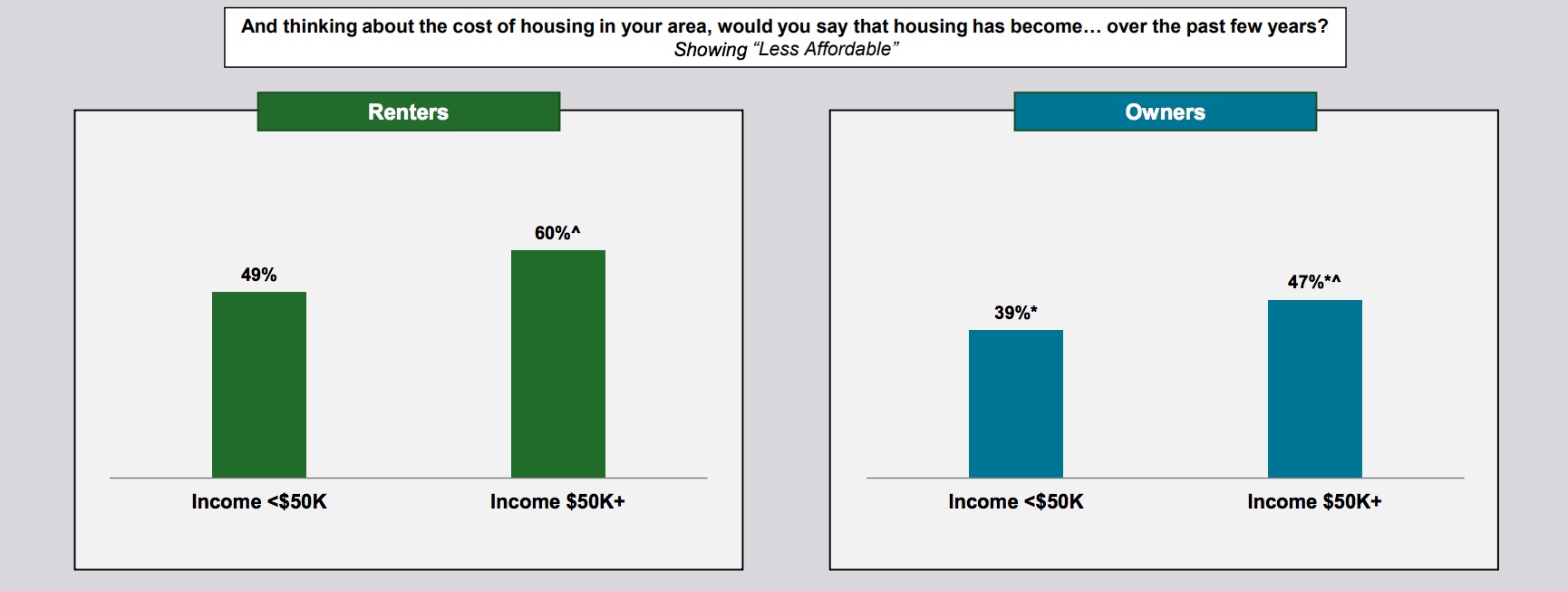

Among both owners and renters, it is those with the higher income who are most likely to call housing unaffordable.

The difficulty of finding affordable housing has led more than half of all those responding, and more than three-quarters of renters, to attempt to curtail their non-housing spending. These actions include skipping vacations, living with roommates, and cutting back on day-to-day spending.

Most people tend to report being satisfied with the characteristics of where they live, with owners expressing slightly more satisfaction across a number of community attributes including proximity or access to work and the quality of local schools and stores. Renters, however, are more satisfied with their access to public transportation.

While homeownership was the preference of most respondents, renters and owners displayed significant differences in their attitudes toward both the financial and the lifestyle advantages of owning versus renting. Thirty percent of renters thought they were making the right financial decision on the basis that "Renting makes more sense because it protects you against house price declines and is actually a better deal than owning." Only 7 percent of owners agreed with this statement while 90 percent agreed that "Owning makes more sense because you're protected against rent increases and owning is a good investment over the long term." Among renters, 67 percent thought homeownership was a better financial choice.

When it comes to lifestyle, 39 percent of renters and 12 percent of owners thought renting was preferable because it was less stressful and provided for more flexibility in future decision making. Far more owners (86 percent) than renters (56 percent) agreed with the statement that "Owning makes more sense because you have more control over where you live and a better sense of privacy and security."

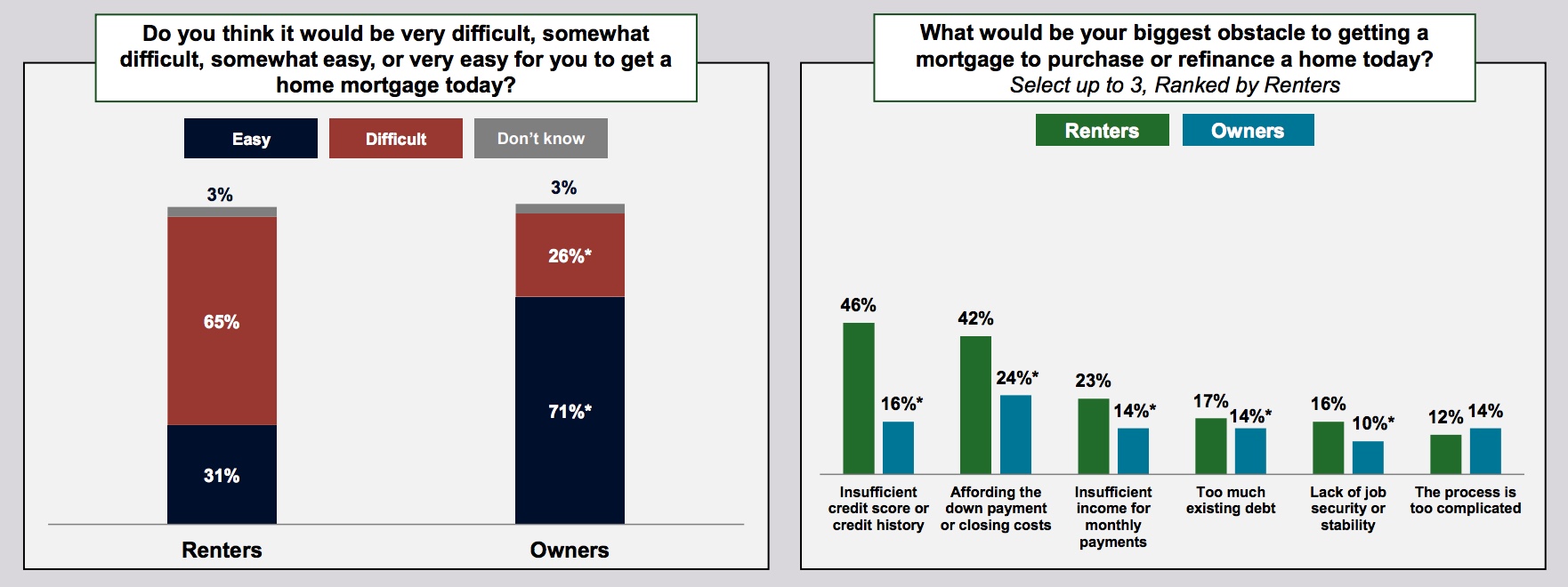

While homeownership might be a goal, renters expressed a good deal of doubt about their ability to get there. Sixty-five percent thought it would be difficult for them to get a mortgage compared to 26 percent of owners, and renters expressed much more concern about their credit or ability to provide a down payment than the other group. Palim says that "For some, these factors might take years to address.

Fannie Mae says its study "underscored a frequently overlooked aspect of the housing inventory shortage: the possible impact that existing homeowners' affordability concerns have on their willingness to put their home up for sale and re-engage as a potential buyer.