For months, the National Association of Home Builders (NAHB) has been citing lumber prices as one of the headwinds faced by new home builders as they try to pick up the pace of construction. Those prices nearly doubled over a four-month period in 2020, reaching an all-time high in September. Since then, they have continued their volatility and are now considerably higher than that September peak. Builders say the price and availability of building materials is the top challenge they currently face.

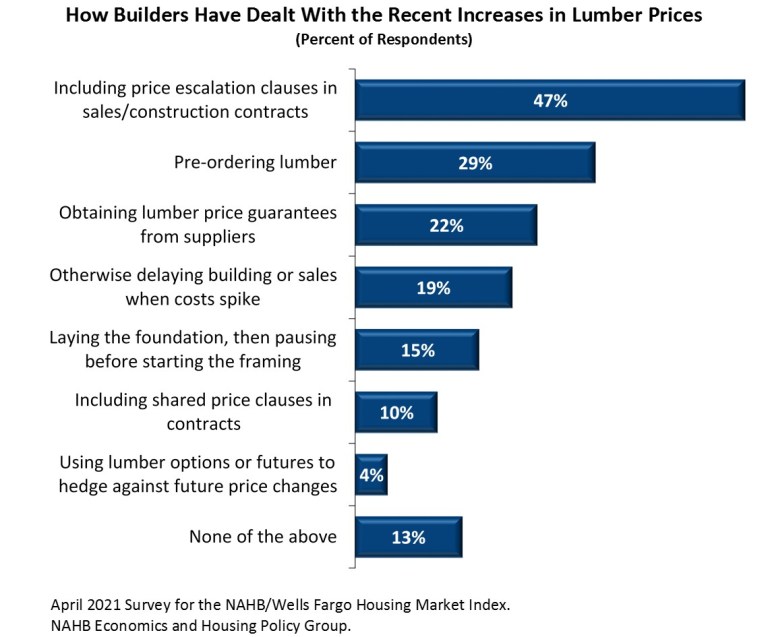

In their most recent NAHB/Wells Fargo Housing Market Index survey, NAHB asked their builder members how they are handling the increasing prices. The most common response, given by 47 percent of those responding was by "including price escalation clauses in their sales contracts." Paul Emrath, writing about the survey in NAHB's Eye on Housing blog, says these clauses tie the final house price to the price of building materials while an additional 10 percent of builders are including clauses sharing the increased amount between buyer and seller.

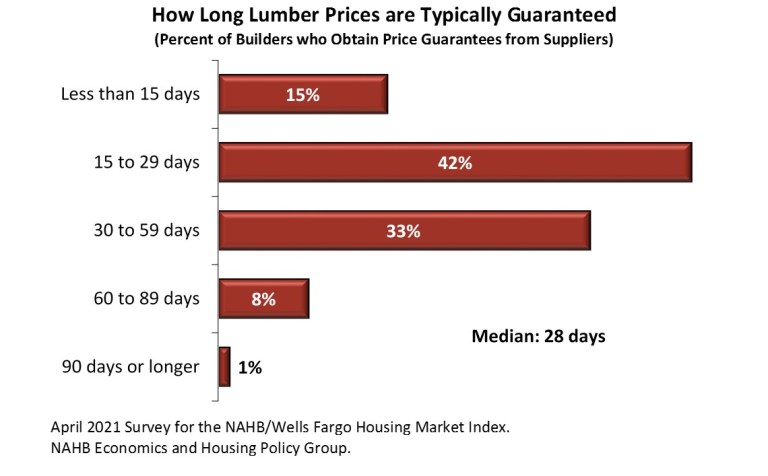

Twenty-nine percent of builders said they have been pre-ordering lumber and another 22 percent said they were obtaining price guarantees from suppliers. The length of time they have been able to lock prices in varies from around two weeks to (rarely) over two months. The median length of the guarantee was reported at 28 days.

Emrath says none of the practices cited by builders completely compensates for the recent historic surge and volatility in lumber prices. While price escalation clauses appear to offer some protection, they don't prevent the loss of sales to customers unable to afford the escalated house prices.

He adds that housing starts have been relatively strong lately (they were up 19.4 percent in March), but NAHB research shows the strength is due largely to demand at the high end of the income distribution. A large number of households with more modest incomes have been priced out of the market for new homes. Also, the rising number of unused permits is a sign of some stress in the market. The U.S. Census Bureau reported there were 217,000 backlogged permits at the end of March, a 36.5 percent increase from a year earlier.