Fourth quarter statistics on the activities of Freddie Mac and Fannie Mae (the GSEs) in assisting homeowners to stay in their homes were released today by the Federal Housing Finance Agency. The Foreclosure Prevention and Refinance Report for the fourth quarter includes new state level data and launches an interactive Fannie Mae and Freddie Mac State Borrower Assistance Map showing the number of loans owned or guaranteed by the GSEs, delinquencies, foreclosure prevention activities, real estate owned (REO) properties, and refinances in each state. The interactive map can be viewed here.

Highlights of the Quarterly Report.

-

Modifications

through the Making Home Affordable Program numbered 19,500 during the fourth

quarter bringing the total since the program began to approximately

400,000. Nearly 36,400 borrowers were in

a HAMP trial period at the end of the quarter, down from 42,300 at the end of

the third quarter. About 13,000

permanent modifications defaulted during the quarter bringing the total

defaults for the two GSEs to 79,356 over the life of the program.

- The Home Affordable Refinance Program (HARP) has refinanced 1,021,800 GSE loans since its inception in March 2009. Nearly 10 percent of this total occurred during the fourth quarter with 53,000 financings under Fannie Mae and 40,000 under Freddie Mac.

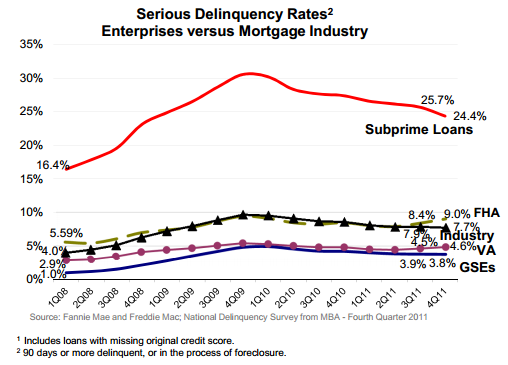

- The GSEs continue to have lower serious delinquency rates than other types of loans. The two had a combined rate of 3.8 percent in the fourth quarter, down from 3.9 percent in the third quarter. The fourth quarter rates for the industry as a whole in the fourth quarter was 7.7 percent; FHA was 9.0 percent, and the VA 4.6 percent. Nearly one quarter of the industry's subprime loans is seriously delinquent. Freddie Mac's serious delinquency rate was 4.1 percent, unchanged from the third quarter while Fannie Mae's rate dropped from 4.8 percent to 4.7 percent.

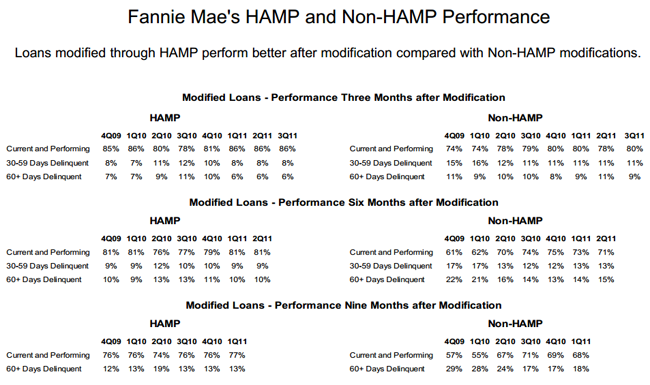

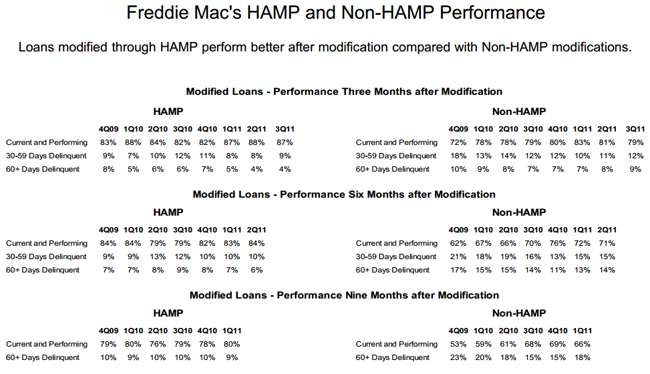

- GSE loans that have gone through HAMP modifications perform much better than GSE loans that were modified through other programs. This has been true since the beginning of HAMP and for both Freddie Mac and Fannie Mae mortgages

- Both Freddie Mae and Fannie Mae loans continue to perform well after modification. Nine months after modification over 73 percent of GSE loans are current and performing.