The Federal Housing Finance Agency, conservator of Freddie Mac and Fannie Mae has produced a scorecard for the two government sponsored enterprises (GSEs) which it said will serve as a roadmap for the new FHFA Strategic Plan announced last month. The Scorecard lists specific objectives and timetables for the GSEs to accomplish the plan's objectives.

At the same time FHFA announced the details of new executive compensation programs at the GSEs which will reduce top executive pay by nearly 75 percent from pre-conservatorship levels, eliminate bonuses, and establishes a target for the CEOs of the two companies at $500,000. FHFA has been in a dispute with Congress over executive compensation with Congress demanding that GSE pay levels be brought into line with those of federal agencies and introducing legislation to that effect. FHFA has argued that it was necessary to keep senior level pay competitive with that of other large financial institutions and commensurate with the uncertainty, stress, and criticism GSE executives encounter in their jobs. According to FHFA, the compensation for the five top executives at each firm is more than 30 percent below the 50th percentile for comparable positions and will be 50 percent below the median with the proposed changes.

The Scorecard consists of four major weighted objectives, each with sub-objectives and goals, targets and measures, and deadlines for each.

1. Build a New Infrastructure (30 percent). This includes continued progress on or completion of market enhancement activities, development of a securitization platform and Pooling and Servicing Agreements.

2. Contract the Enterprises' dominant presence in the marketplace while simplifying and shrinking certain operations (30 percent). This requires working with FHFA to develop options for shifting credit risk to private investors, risk sharing, and pricing.

3. Maintain foreclosure prevention activities and credit available for new and refinanced mortgages (20 percent). Loss mitigation is to include continued evolution of Servicer Alignment Initiative, enhancement of short sales, deeds in lieu, and deeds-for-lease programs, and facilitation of real estate sales (REO).

4. Manage Efficiently in Support of Conservatorship Goals (20 percent). This includes concluding litigation and loan repurchase claims, prioritizing and managing GSE goals, ensuring corporate governance procedures are maintained, and seeking and considering public input.

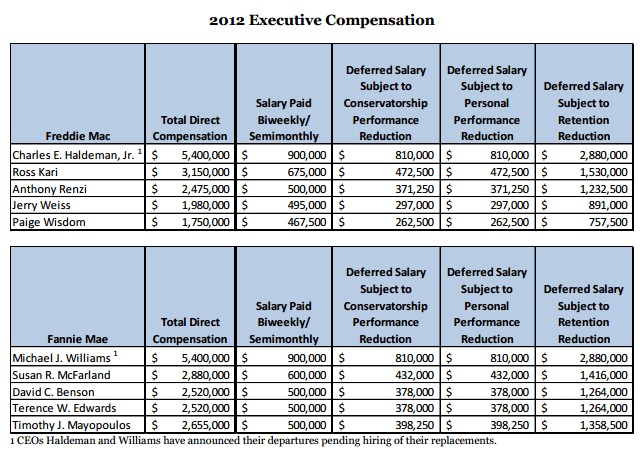

The new compensation package includes a retention feature and reductions for missed performance and eliminates incentive plans that have been in place for three years. The new structure consists of base salary paid in bi-weekly or twice-monthly installments, and deferred salary paid after a one year deferral. Total direct compensation is being reduced by 10 percent and there are no bonuses. Deferred salary is equal to 30 percent of total salary and one-half is subject to a reduction based on the GSE's performance against the Conservatorship Scorecard as determined by FHFA and the other had is subject to a reduction based on individual performance.

In addition to the 75 percent reduction in pay that FHFA says has occurred post conservatorship, the GSEs have reduced the number of senior executives at each firm from a pre-conservatorship level of 91.

In setting the new compensation level, FHFA said it concluded that any further reductions or uncertainty around compensation would heighten safety and soundness concerns around the GSEs.