Bankers responding to the January 2010 Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices indicated that residential loan standards are still contracting. The report also states that consumer demand for mortgage loans continues to decline.

The survey, released on Monday, addresses changes in loan supply and demand over the last three months. It also included three sets of special questions about delinquency rates of loans made to large and middle market firms, changes in bank policies about commercial real estate (CRE) loans over the past year, and a third set of questions about the banks' outlook over the coming year for the credit quality of a number of categories of loans. 55 domestic banks and 23 U.S. branches and agencies of foreign banks responded to the questionnaire.

Banks continued to tighten standards on residential lending, especially on nontraditional residential real estate loans. 17 percent of banks that make residential loans reported they had tightened standards on prime real estate loans and 30 percent reported such tightening of non-traditional loans.

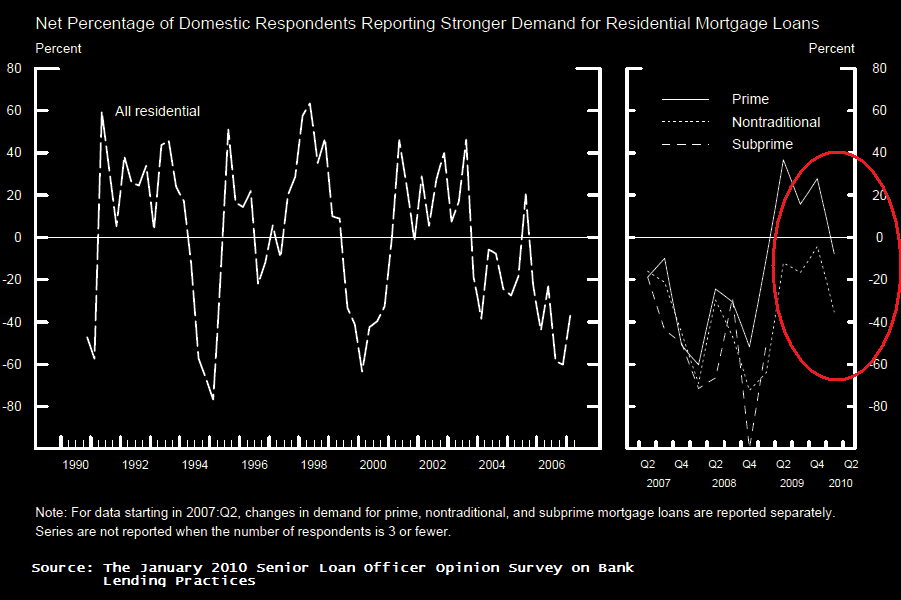

In addition, a moderate net fraction of banks reported weaker demand from prime borrowers for residential real estate loans. Demand from customers seeking nontraditional mortgages also weakened further over the survey period. Only a small net fraction of banks reported having tightened standards on revolving home equity lines of credit over the past three months, but a large net fraction of banks continued to report lower demand for such loans.

Demand for both businesses and households across all major categories of loans weakened on net over the past three months. 64 percent of respondents reported that business inquiries about new or increased credit had stayed about the same over the last three months while 13 percent reported an increase and 25 percent a decrease.

A large proportion of respondents reported that their banks were relatively unchanged in their approach to consumer lending. Over 80 percent said that their banks policies were unchanged when it came to approving applications for installment, consumer, and credit card loans. However, a substantial net fraction of banks said they had reduced credit limits on credit cards and had become less likely to issue cards to customers who do not meet credit scoring thresholds. Respondents to the October 2009 survey had indicated that they would tighten many of their credit card policies as a reaction to passage of the Credit CARD Act.

Loan terms were seen as being a little more in flux but the net percentages of respondents who tightened those requirements was lower than in the previous quarter. When considering lending to large firms - those with annual sales of $50 million or more - 76 percent reported there had been no change in the maximum credit lines, 16 percent reported a tightening in the maximums and 7 percent said those terms had eased. Maximum maturity dates were unchanged in 83 percent of reports. Only 64 percent of respondents reported no change in the cost of credit lines while over 23 percent reported that these standards had tightened somewhat or considerably. Close to 26 percent reported that the spread charged to commercial borrowers had widened over the last three months compared to 58 percent that reported it unchanged. About 10 percent reported they had tightened collateral requirements, the remainder reported no change. Figures for lending to smaller companies varied only slightly from those reported for large firms.

Banks were also asked a special set of questions about asset quality. In contrast to responses in earlier surveys, substantially fewer respondents reported that they expected widespread deterioration in credit quality in the coming year. On the household side, a moderate net fraction of banks indicated that the credit quality of their prime residential mortgages and home equity loans would likely deteriorate further in 2010. However, banks expect portfolios of most other types of consumer and residential real estate loans to experience little further deterioration in credit quality this year—indeed, a moderate net share of banks expect some improvement in credit quality in other consumer loans.