Acting Federal Housing Finance Agency (FHFA) Director Edward J. DeMarco responded Friday to a request from 16 House Democrats to explain the statutory authority that DeMarco has claimed prohibits FHFA from offering principal reduction as part of loan modifications on loans it owns or guarantees. The request was made last November after DeMarco told the House Committee on Oversight and Government Reform that his agency had concluded that "the use of principal reduction within the context of a loan modification is not going to be the least-cost approach for the taxpayer." When a committee member pointed out that several banks are already implementing principal reduction programs in an attempt to help delinquent or underwater homeowners and citing specific examples, DeMarco said "I believe that the decisions that we've made with regard to principal forgiveness are consistent with our statutory mandate," and committed to providing documentation of that statutory authority to the Committee.

In a letter sent to the Committee's ranking member Elijah Cummings (D-MD) DeMarco laid out the statutory requirements as originating in three congressional mandates; first FHFA's role as conservator and regulator of the government sponsored enterprises (GSEs) which requires it to preserve and conserve the assets and properties of the GSEs; second, maintaining the GSE's pre-conservatorship missions and obligations to maintain liquidity in the housing market; and third, under the Emergency Economic Stabilization Act of 2008 (EESA), FHFAs statutory responsibility to maximize assistance to homeowners to minimize foreclosure while considering the net present value (NPV) of any action to prevent foreclosures.

The focus of the letter, however, is not the statutory framework but rather why FHFA has decided that principal forgiveness does not meet its core responsibility within that framework to preserve and conserve the assets of the GSEs.

DeMarco's rationale relies on an internal analysis provided to him in December 2010 and updated in June 2011 which shows that the use of principal reduction as a loss mitigation measure for GSE loans under with the Making Home Affordable (HAMP) program or the FHA Short Refi program would cost the Enterprises more than the benefits derived and recommended that, instead the GSEs should more aggressively pursue propriety loan modifications that reduce the interest rate, extend the mortgage term, and provide for substantial principal forbearance and promote HARP refinance transactions for borrowers who are current on their mortgages but underwater in respect to their equity.

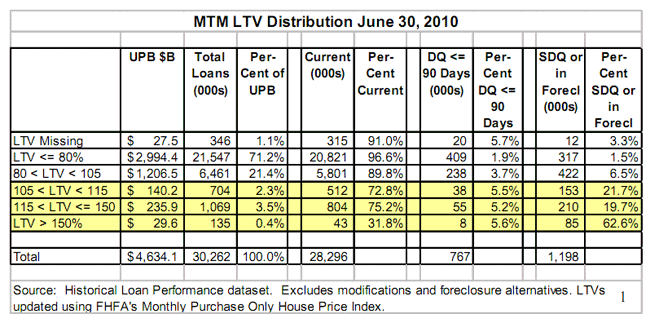

The GSEs collectively guarantee or hold about 30 million loans and, using the FHFA Home Price Index to estimate home values it appears that less than two million of these loans are secured by properties valued at less than the outstanding debt; i.e. underwater. Of these loans, more than half are performing and about one-half million are severely delinquent or in foreclosure. The table below clearly shows that high LTV loans are only a small proportion of the GSE's loans and that most of the loans are either current or severely delinquent.

Using the Treasury HAMP NPV model the FHFA study team compared the economic effectiveness of forgiving principal down to a mark-to-market LTV (MTMLTV) level of 115 percent versus forbearance of the same amount of principal for all loans with a MTMLTV greater than 115 percent. The model suggested no better result from principal reduction than from forbearance and showed the latter as slightly more effective in reducing GSE losses. The team also evaluated the accounting and operational implications of the principal reduction to measure those costs against benefits to borrowers. The costs were found to include, in addition to the immediate losses, the costs of modifying technology, providing training to servicers, and the opportunity cost of diverting attention away from other loss mitigation activities.

Principal forbearance, in contrast, requires no systems changes and is a common approach in government credit programs, including FHA. The borrower is offered changes to the loan term and rate as well as a deferral of principal, which has the same effect on the borrower's monthly payment as principal reduction, but provides the investor with potential recovery. The forborne principal is paid in full or part upon sale of the property or payoff of the loan. This traditional approach would minimize the Enterprise losses and treat GSE borrowers in a manner that is consistent with other government programs.

Given the large portion of the high LTV borrowers that are current on their mortgages, a principal reduction program for this segment, such as the FHA Short Refi program, simply transfers performing GSE borrowers over to FHA, at a cost to the GSEs. A less costly approach for the Enterprises to assist these borrowers is to provide a GSE refinance alternative, such as HARP. Clearly, the HARP program has been underutilized to date, suggesting that the program features should be revisited to remove barriers to entry wherever possible.