The FHFA today released the Foreclosure Prevention & Refinance Report for the Third Quarter 2009. This report is intended to provide disclosure and analysis of Fannie Mae and Freddie Mac loan data. It discusses the GSE's loan portfolio size and composition, the performance of the portfolio, and provides an update of foreclosure prevention objectives.

Mortgage Portfolio Size and Composition

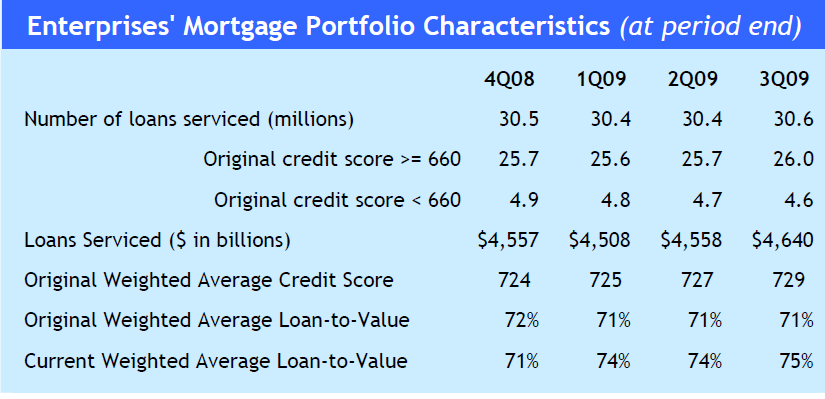

The Enterprises’ aggregate mortgage portfolio increased by approximately 218,000 loans or 0.7 percent during the third quarter of 2009 as new purchases and issuances outpaced loan liquidations.

The number of first-lien residential mortgages with credit score at origination of 660 or higher increased by 1.2 percent, while mortgages with less than 660 credit score at origination decreased 2.2 percent during the quarter. The current weighted average loan-tovalue (LTV) ratio of Enterprises’ mortgage portfolio increased to 75 percent as of September 30, 2009, from 71 percent as of December 31, 2008. The increase in the estimated weighted average current LTV ratio reflects the impact of prolonged and severe decline in home prices.

Here is a table from the report summarizing the data:

Refinance Activity

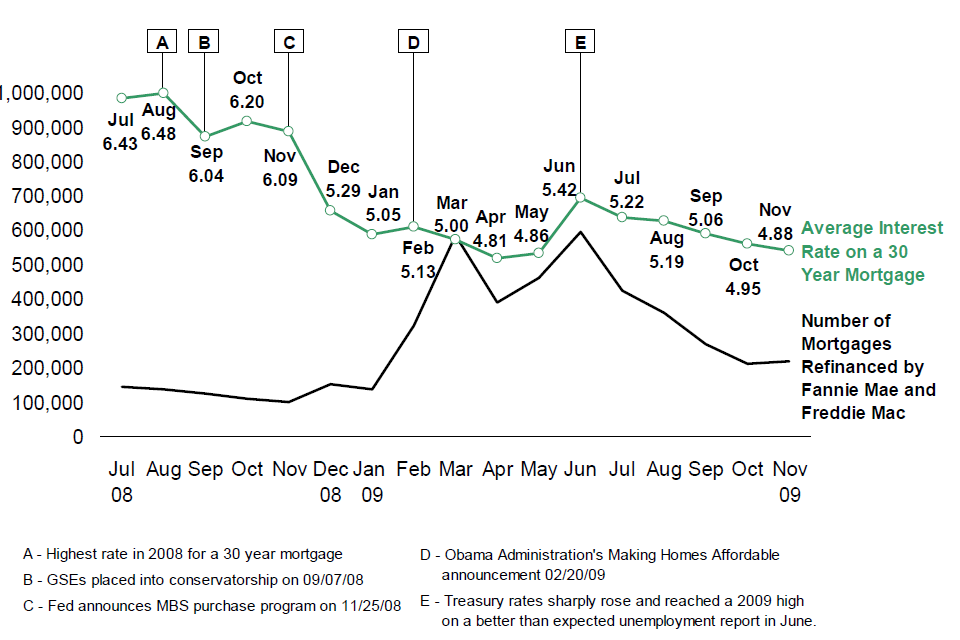

Fannie Mae and Freddie Mac have refinanced nearly 4 million loans year-to-date through November 2009. The total refinance volume dropped in 3Q09 and October after the rate for a 30-year mortgage rose in June and remained above 5 percent throughout the third quarter.

Total refinance volume then rose in November in response to a sustained decline in rates. Refinance volumes are strongly influenced by mortgage rates with the effect most visible after a lag.

Mortgage Performance

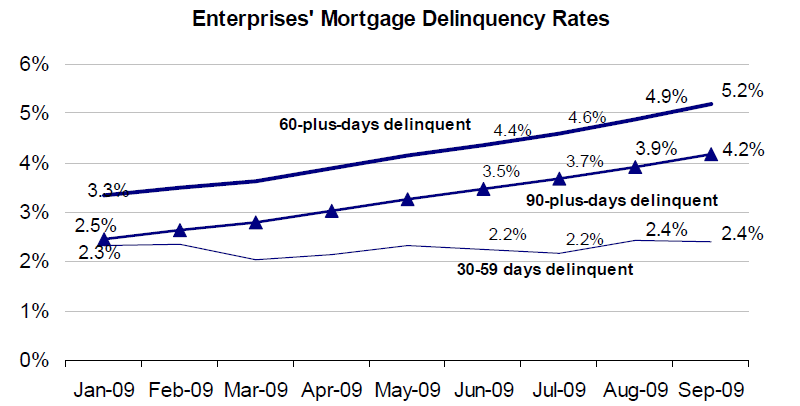

The number of loans in all stages of delinquency increased nearly 100 basis points to 7.6 percent of the combined portfolio

The serious delinquency rate (90 days or more delinquent, or in the process of foreclosure) increased 70 basis points to 4.2 percent while the 30-59 days delinquent rate rose 20 basis points to 2.4 percent during the third quarter.

The 60-plus-days delinquent rate (60 days or more delinquent, or in the process of foreclosure) rose 80 basis points to 5.2 percent as of September 2009, from 4.4 percent at the end of second quarter.

Nearly 1.6 million of the Enterprises’ mortgages were 60-plus days delinquent as of September 30, 2009, an increase of 260,300 mortgages during the third quarter.

Delinquency rates for borrowers with original credit scores of less than 660 continued to increase faster than for borrowers with credit scores of 660 or higher. The 60-plus days delinquency rate of loans with credit scores at origination of less than 660 increased 240 basis points during the third quarter. The 60-plus days delinquency rate of higher original credit score loans increased 60 basis points during the third quarter.

The increase in the 60-plus-days delinquency rate is attributable in part to continued deterioration in the Enterprises’ books of business as home price and economic conditions remain challenging. However, also contributing to the increase is the fact that many loans are remaining delinquent for a longer period of time before proceeding to a foreclosure sale or other liquidation. New HAMP trial modifications and other relief measures entered into by the Enterprises result in loans staying in a delinquent status until the execution of a permanent HAMP modification or successful completion of a repayment or forbearance plan.

Additionally, the Enterprises have issued specific instructions to mortgage servicers to refrain from completion of a foreclosure sale or other form of liquidation until a borrower has been sufficiently considered for a home retention solution, such as a modification, repayment or forbearance plan.

Foreclosure Prevention Actions

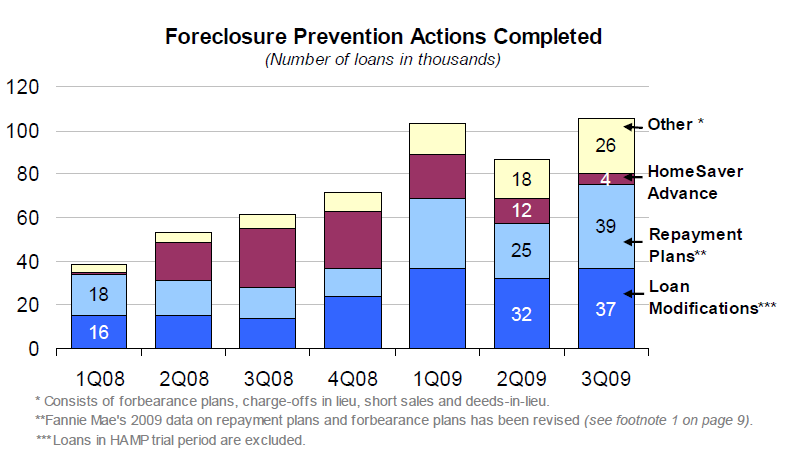

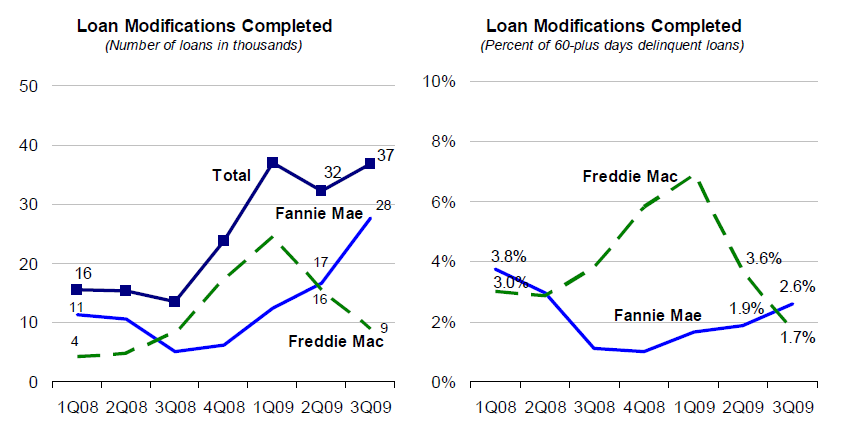

Freddie Mac and Fannie Mae continued to increase their foreclosure prevention activities during the third quarter of 2009, which in the case of the two government sponsored enterprises (GSEs) ended November 30. The two increased the number of completed workouts by 22 percent over Q2 results and reported a lower rescission rate from their more recent loan modification efforts than had been documented earlier.

During the third quarter the GSEs completed a combined total of 105,500 foreclosure prevention workouts compared to 86,800 during the second quarter. There were an additional 278,100 trial modifications entered into under the Treasury Department's Home Affordable Mortgage Program (HAMP), but the majority of these must complete a three month trial period before being counted as complete. HAMP modifications are now the primary modification type used by the GSEs because they offer immediate payment relief to borrowers. Borrowers ineligible for this program, primarily because their housing costs are already below 31 percent of income, are referred to other prevention programs. During the 11 months of 2009 reported, the GSEs have entered into over 574,000 foreclosure prevention activities.

Only 22,000 loans that entered HAMP trial modifications with the GSEs had been completed by the end of November; with Fannie Mae finalizing about 1,500 more than Freddie Mac. This performance is consistent with that of other agencies involved in the program and the GSEs report similar reasons for the lack of volume; missing documentation from lenders and disqualifications on the basis of income found after the trial period began. Like FHA and other HAMP agencies, Freddie Mac and Fannie Mae say that they are aggressively addressing the documentation problems and are referring disqualified borrowers to other programs.

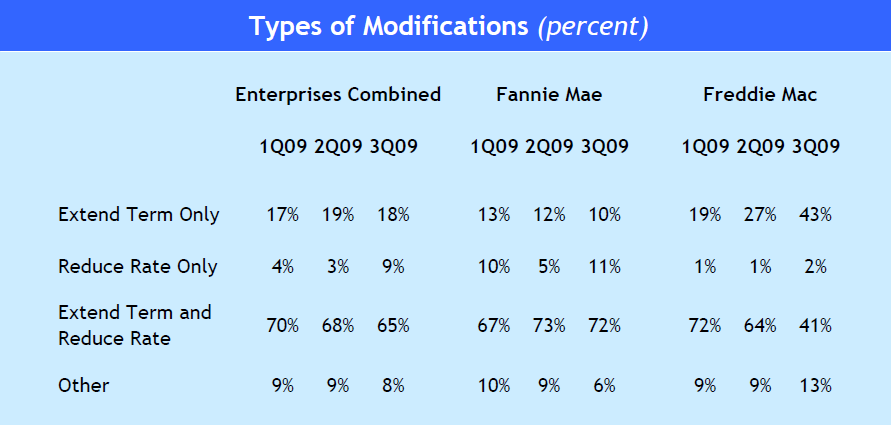

The two Enterprises differed in their modification methods. Fannie Mae both extended the term of the loan and lowered the interest rate in 72 percent of the mortgages it modified. Freddie Mac followed this course in only 41 percent of the cases and only extended the term in 43 percent.

Approximately 87 percent of all completed loan modifications resulted in a lower monthly payment. Modifications that increased this payment by up to 20 percent represented 37 percent of all modified loans, an increase from 32 percent in the second quarter but those that increased payments by more than 20 percent decreased from 54 to 40 percent.

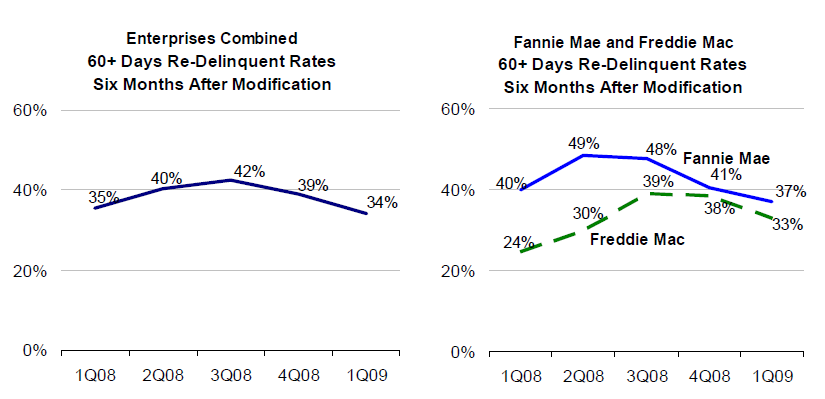

Loans modified in recent months are performing better six months after modification than did earlier modifications, but the numbers are still dismal. Six months after completing the modification, 34 percent of loans modified during the first quarter of 2009 were still current compared to 39 percent of those modified during 2008. This is the second consecutive quarter that loans have shown improvement, but the success of foreclosure prevention is as much dependent on the job market and other improvements in the economy as on any changes made by the GSEs.

Foreclosures

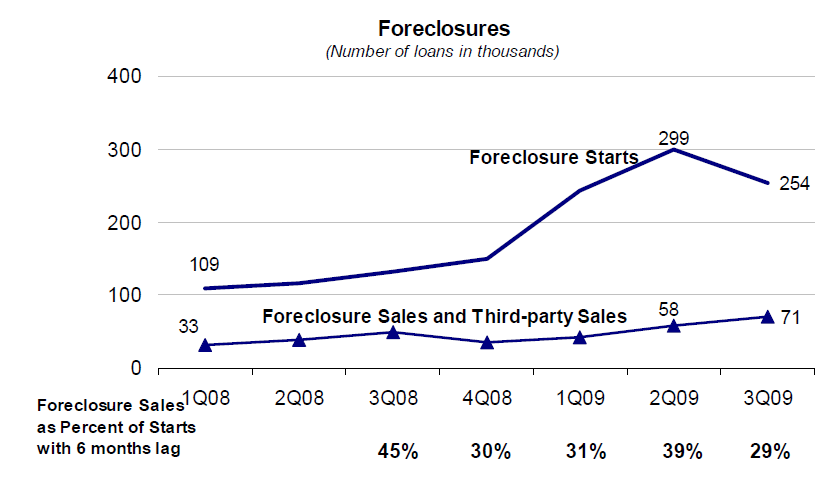

Foreclosure starts decreased during the quarter from 299,000 to 254,200. Completed foreclosures and third party sales rose from 57,800 to 71,000 over the quarter but the proportion of foreclosure starts transitioning to completed foreclosures declined, primarily reflecting activities under the HAMP program.

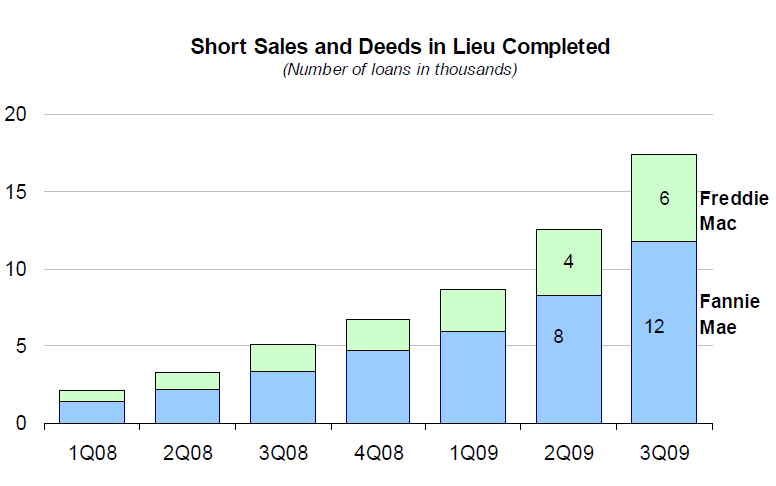

Short Sales and Deeds in Lieu

The volume of short sales and deeds in lieu approved by the GSEs increased during the third quarter to a total of 17,400, an increase of 39 percent over the second quarter. Home forfeiture actions such as short sales and deeds in lieu of foreclosure continued to increase during the third quarter. This reflects the increasing number of borrowers that no longer have the capacity or desire to retain their homes, due to unemployment, underemployment, negative equity, or other factors affecting the household’s financial situation.

In a short sale, the borrower sells the homes for less than the full payoff amount due on the mortgage and lenders accept such amounts. Alternatively borrowers may convey title to the home to the servicer through a deed-in-lieu of foreclosure. Short sales help to keep REO inventories down and both short sales and deeds in lieu help to minimize the impact of foreclosure on borrowers and neighborhoods.

The next reports coming from the Federal Housing Administration and the GSEs will include data collected more than six months after the implementation of HAMP. While there was a start-up period and few loans entered the program before mid-summer, these upcoming reports should contain the first really useful data on the program. Hopefully they will show that the first of the thousands of homeowners who started the process have successfully completed their trial periods, moving into permanent modifications rather than forming the front edge of a new wave of foreclosures.