Mortgage rates held steady yesterday near what might turn out to be the most aggressive levels of 2010. Mortgage backed securities prices did not move too high or too low without quickly correcting, not much progress was made in any direction yesterday or for the last few weeks for that matter .

Early this morning, the Mortgage Bankers Association released their weekly Mortgage Applications Index. The MBA survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. A rising trend of mortgage applications indicates an increase in home buying interest, a positive for the housing industry and economy as a whole. More home purchases can lead to more construction jobs and increased purchases of items to build a home. Furthermore, in a low mortgage rate environment, an increasing trend implies consumers are seeking out lower monthly payments which can result in increased disposable income and therefore more money to spend on discretionary items or to pay down other debt.

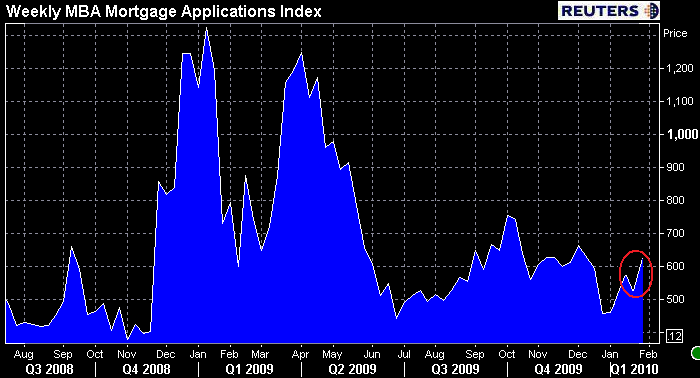

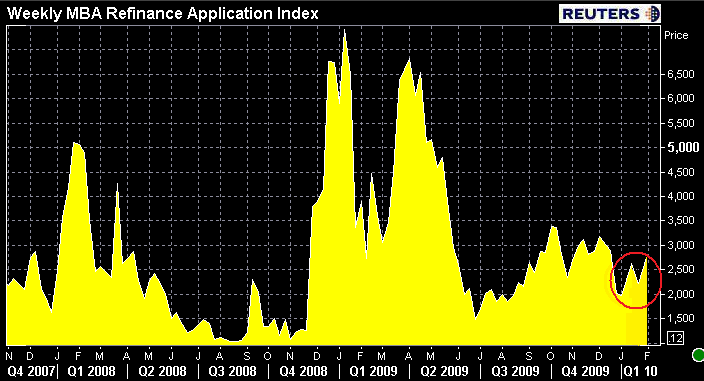

In last week's release, which reported on the week ending January 22, total mortgage applications decreased 10.9%. The Refinance Index fell 15.1% while the Purchase Applications Index moved 3.3% lower.

This morning the MBA told us that mortgage applications rebounded in the most recent week.

Total loan apps were up 21.0%....

Purchases applications were 10.3% higher...

Refinance demand increased 26.3%....

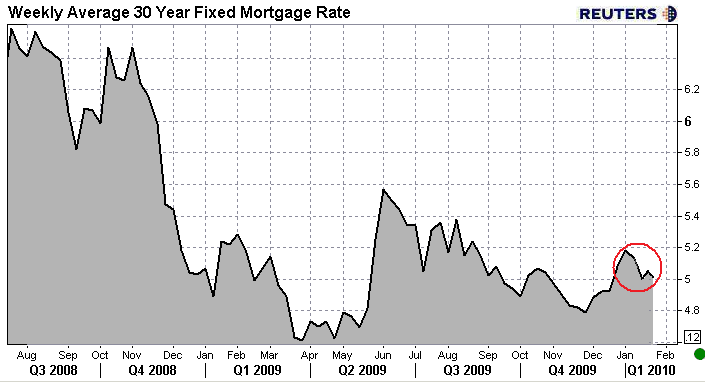

The average 30 year fixed conventional mortgage rate, including 1.04 origination points, fell from 5.02% to 5.01%.

In the release, Michael Fratantoni, MBA's VP of Research and Economics, warned to expect rising mortgage rates over the next few months as the Fed exits the MBS buying program.

"Mortgage application volume rebounded last week, returning the purchase and refinance indexes to levels from mid-December," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Rates continue to hover around 5 percent, quite low by historical standards, but are well above the record lows seen in 2009, and hence are not generating substantial refi volume. We expect that rates will rise over the next few months as the Federal Reserve winds down its MBS purchase program, and this will likely lead to a decline in refinance volume."

This is line with recent guidance issued on Mortgage News Daily. Don’t wait for mortgage rates to decline! I stand by my statement that 4.75% could very well be the lowest mortgage rates offered in 2010...unless there is a fundamental shift in economic outlook. If you have been waiting to refinance or to buy, get out there and start the process before you miss the boat of sub 5% rates.

Later in the morning we got a sneak peek into the health of the labor market with the release of the ADP Employment report. This data is an unofficial preview of Friday’s Non-Farm Payrolls, it is always released on the Wednesday prior to the government’s official Employment Situation Report. Historically, the ADP report has varied greatly from the official report but its accuracy has been improving lately. The biggest difference between the two jobs reports is the ADP numbers do not take into account government hiring, only the private sector.

The report indicated that U.S. companies cut 22,000 jobs last month, barely beating economists estimates for a loss of 30,000. This was the lowest number of job losses in two years, according to ADP. Last month’s report was revised better from an initial loss of 84,000 to a loss of 61,000 jobs. With the preview over, the interest rate market spotlight is on the Employment Situation, due out on Friday morning. Economists are expecting 5,000 jobs were created in January and a 10.1% unemployment rate. READ MORE ON THE NFP FORECAST

Our final economic report to hit news wires this morning was a read on the strength of the non-manufacturing sector of our economy: the ISM Non-Manufacturing Index. The Institute for Supply Management(ISM) surveys 400 firms including mining, construction, retail, etc.. on the strength of business conditions. Readings above 50 indicate improving conditions while readings below 50 indicate contraction. Last month’s report edged higher to 50.1 from the prior month’s 48.7 reading. Economists surveyed expected this month’s survey to continue to show improving conditions with a reading of 51.0. Earlier this week we got the ISM Manufacturing Index which came in much better than expected, indicating the manufacturing sector of our economy continues to improve. This supports theories that the economy is improving, which will pressure mortgage rates higher.

The report indicated the non manufacturing sector of our economy is improving, but at a slower rate than expected. The survey registered a 50.5 reading. There was no reaction from the markets following the release.

Lastly, this morning the Department of Treasury announced the supply of next week’s auction. They will offer $40billion 3 year notes next Tuesday, $25billion 10 year notes next Wednesday, and $16billion 30 year bonds on Thursday. As always, more supply of debt in the marketplace requires an offsetting increase in demand. If demand does not match supply, interest rates will rise to draw in demand. This increases the chance of mortgage rates rising.

Reports from fellow mortgage professionals indicate lender rate sheets to be slightly worse than yesterday’s. The par 30 year conventional rate mortgage remains in the 4.75% to 5.00% range for well qualified consumers. To secure a par rate you must have a FICO credit score of 740 or higher, a loan to value at 80% or less and pay all closing costs including an estimated one point loan origination/discount/broker fee. You may elect to pay less in closing costs but you will have to accept a higher interest rate. If you are seeking a 15 year term, you should expect par in the 4.25% to 4.50% range with similar costs.

As stated earlier, my lock bias is still in place. I do not see much room for rates to move lower than the current levels. If Friday’s Employment Situation report is better than expected or even as forecast, rates could move higher very quickly. If the report on Friday is worse than expected, we do not expect to see significant improvements in mortgage rates, not far from current levels at least. There is much more room to rise than to fall.