New programs offering low downpayment options for GSE loans weren't enough to compensate for more stringent jumbo loan standards in April. This resulted, the Mortgage Bankers Association (MBA) said on Thursday, in a decrease in its Mortgage Credit Availability Index (MCAI).

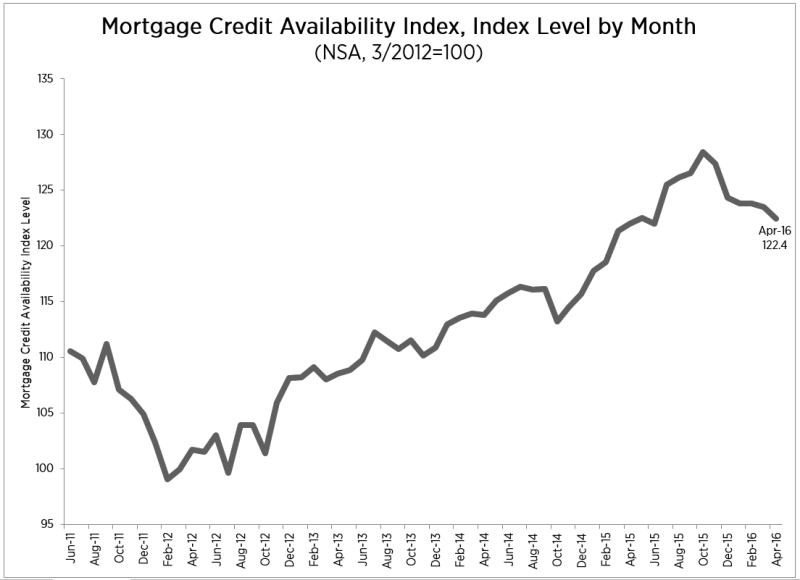

The MCAI registered at 122.5 in April compared to 123.5 in March, a decline of 0.89 percent. The index peaked in October 2015 at 128.4 and has declined almost monthly since then.

The MCAI is designed to indicate the availability of mortgage credit at a point in time. MBA calculates the index and its components using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) gathered through its Weekly Mortgage Applications Survey combined with data from Ellie Mae's AllRegs® Market Clarity® product. A lower MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

Lynn Fisher, MBA's Vice President of Research and Economics commented, "Mortgage credit became less available in April as a result of two opposing trends, resulting in a net decrease to the index. Investors continued to roll out Fannie Mae and Freddie Mac's low down payment loan programs, which had a loosening effect on credit availability. However, this was more than offset by tightening among high balance and jumbo loan programs."

MBA produces four component indices within the Total MCAI, the Conventional Mortgage Credit Availability Index, the Government Mortgage Credit Availability Index, the Conforming Mortgage Credit Availability Index, and the Jumbo Mortgage Credit Availability Index. As indicated by Fisher, the Jumbo index saw the greatest tightening, down 1.4 percent. The conforming MCAI rose 0.1 percent and the Conventional and Government indices declined by 1.0 percent and 0.7 percent respectively.

The Conforming and Jumbo indices have the same "base levels" as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted "base levels" in March 2012. Using data from the MCAI and the Weekly Applications Survey, MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the "base period") relative to the Total=100 benchmark.