Credit available was apparently slightly lower in January than in February, the third straight month that the Mortgage Bankers Associations' (MBA's) measure of that access has declined. The MBA said its Mortgage Credit Availability Index (MCAI) decreased by 0.4 percent to 123.8 in January. A decline in the index indicates that lending standards are tightening, while increases are indicative of loosening credit.

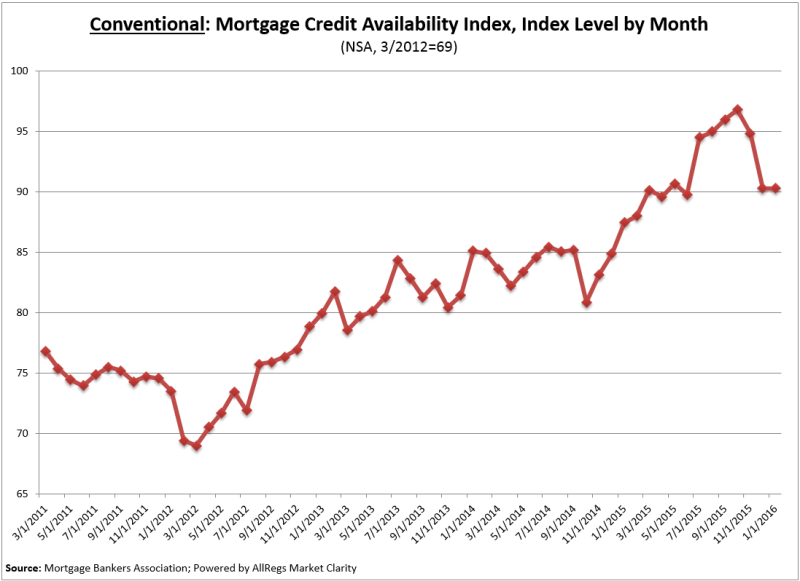

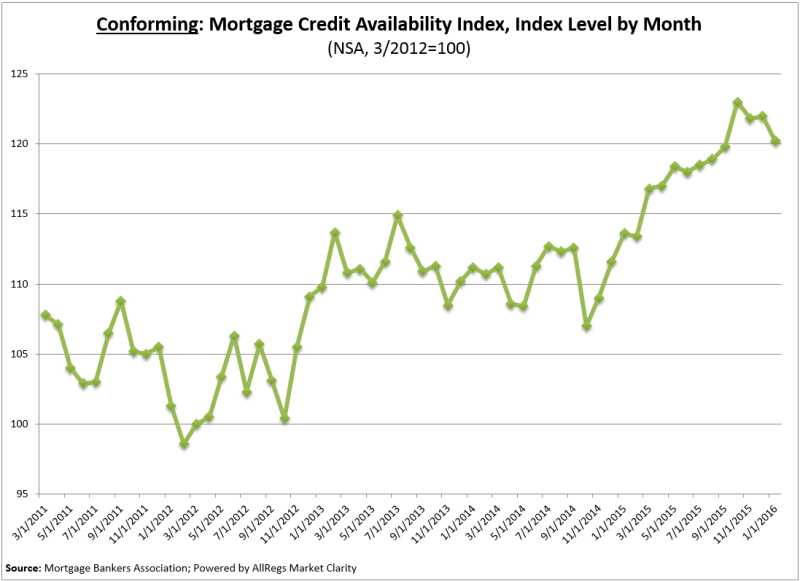

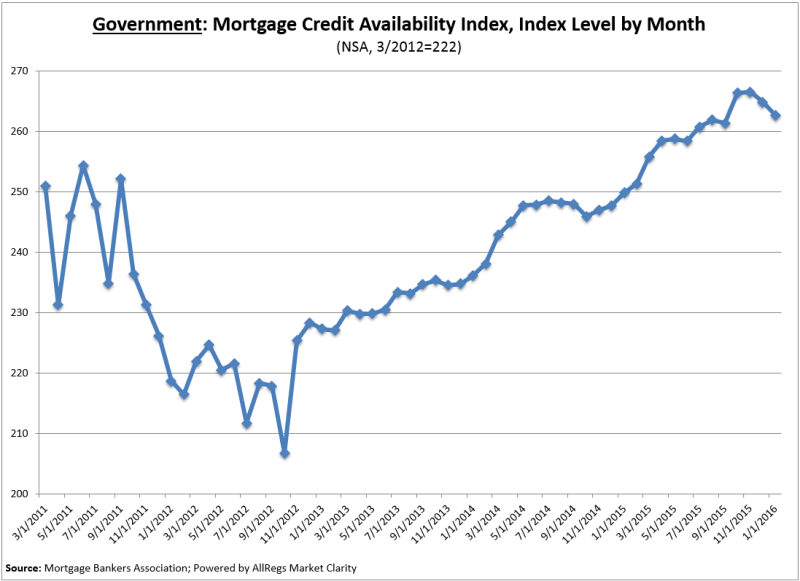

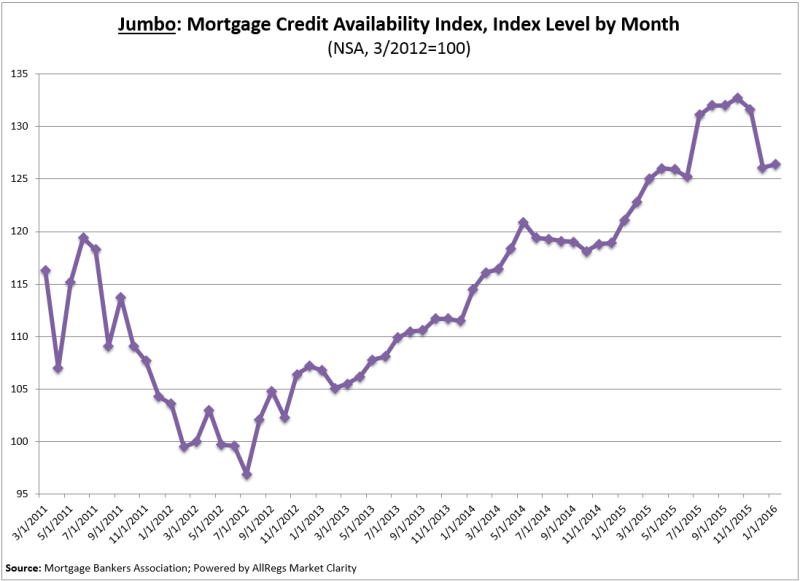

The Index, which was benchmarked to 100 in March 2012, peaked at a post crisis high of 128.4 in October of last year and have dropped every month since although the December change was attributed largely to technical reasons. Two of the four component indices were also lower this month; the Conforming MCAI was down 1.5 percent and the Government MCAI dipped 0.8 percent. The Conventional MCAI was unchanged while the Jumbo index increased 0.2 percent from December.

Lynn Fisher, MBA's Vice President of Research and Economics explained that the lower index reading was driven by a decline in some FHA and conventional offerings. "These declines in the MCAI were only partially offset by loosening among adjustable rate mortgage (ARM) and jumbo lending programs," he said.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via Ellie Mae's AllRegs® Market Clarity® product and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=69; Government March 31, 2012=222.